Dig Deeper into Disability Insurance

Trying to wrap your head around Long-Term Disability insurance? Wondering about the differences between your group Long Term Disability and an Individual Disability plan?

Group benefits plan administrators, have you done your part to ensure your employees understand their coverage and the monthly amount they would receive in the event of a disability?

As benefits advisors in Vancouver, BC, we strongly believe in the need for thoughtful, quality disability insurance products. The focus of this article is to provide deeper insight into the importance of disability insurance, the basics of group Long Term Disability, and how an individual policy may come into place.

Key Takeaways:

- 1 in 6 people will experience a disability before age 65.

- Mental health is the largest category of claims, at 31%.

- Just under 50% of people have group Long Term Disability plans through an employee benefits program. Of those without workplace coverage, only around 15% have individual plans.

- Even with a group Long Term Disability plan in place, many do not have adequate coverage (amount or quality can be lacking).

- It’s essential to know how much coverage you have and to understand how your plan works.

- Employers must be diligent in ensuring employees understand their coverage level and plan parameters.

- Employers can help bridge shortfalls in coverage by organizing for underinsured employees to place top-up disability policies.

- Group Long Term Disability is typically provided through an employer and has set coverage limits and parameters, while individual disability insurance is personally obtained, customizable, portable, and not tied to employment.

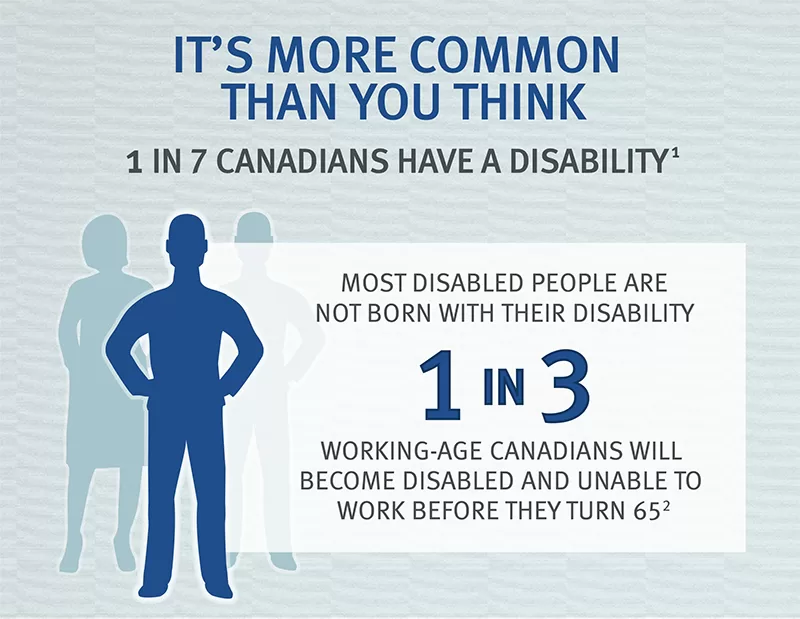

It’s more common to experience a Long-Term Disability than most people realize

Everyone knows someone that’s been diagnosed with a serious illness, or experienced a significant injury – unfortunately, it’s all too common. This almost always means a significant amount of time off work, or in the most serious situations, the inability to work again due to a permanent disability.

While many people consider the medical and lifestyle implications, people often fail to think through the financial impacts of no longer being able to work. There is an expression in the insurance industry- “Your health is your wealth” – and this couldn’t be more true! For most people, being healthy directly ties into their ability to provide for themselves and their families.

Disability insurance is income replacement insurance

Most people are familiar with disability insurance, but they may not think of it for what it really is, which is “income replacement insurance.” But how much do you need? When people are asked “What percentage of your income would you need if you were no longer able to work?” many people state: “All of it.” The fact is, becoming sick or injured usually means more expenses, not fewer. Having your income reduced or eliminated for a period of time can completely derail your ability to stay on track with goals for yourself, your family, and your business.

The statistics are surprising: 1 in 3 Canadians will become disabled and unable to work before the age of 65 (RBC Insurance).

Source: RBC Insurance. “Sales Resource Centre.” RBC Insurance, June 2024, www.rbcinsurance.com/salesresourcecentre/file-777224.pdf. Accessed 28 June 2024.

A common misperception surrounding disability insurance

Many people believe that all medical costs relating to serious life-impacting illness and injury are insured either through provincial health care or your employer-sponsored extended medical plan.

Unfortunately, this is rarely true. Many expenses arise in connection with disability, including:

- Uninsured medical expenses for equipment, drugs, and practitioners (physiotherapy, orthopedic braces etc)

- Time off work for the other spouse to be a caregiver

- Modifications to your home (ramp, grab rails, renovations to relocate bedrooms, etc.)

- Assistance with childcare, cleaning, cooking or other daily activities

Disability insurance provides you with a continuing income while you are unable to work.

Far too many people are not insured or are under-insured

Just under 50% of people have group Long Term Disability plans through an employee benefits program. Of those without workplace coverage, only around 15% have individual plans.

Unfortunately, many people are completely uninsured in this area. This means if something were to happen, they would be reliant on just EI Sickness benefits through Service Canada. The 2024 maximum payment is 55% of your weekly earnings, to a max of $668 a week (taxable) for a maximum of 26 weeks duration. There is some coverage through the Canada Pension Plan, but again, it’s difficult to qualify and benefits are minimal.

For most people, this is totally inadequate. The bottom line, relying on government coverage is not ideal.

Why don’t all employers offer group Long Term Disability?

While we encourage employers to implement group long term disability coverage, stats show under half of workplace plans include this crucial coverage line!

A few common reasons are:

- Cost of coverage: Long Term Disability premiums should be employee-paid to create a tax-free benefit in the event of a claim; it can be difficult to get employees on board with paying a portion of the benefits premiums, especially if the plan has traditionally been an employer-paid benefit. Unfortunately, employees often misunderstand the importance of this coverage line and simply do not want to pay the premium.

- Uninsurable industries: Some industries are difficult or impossible to insure due to the risk of claim; different insurers have different requirements, but all have industry lists of occupations they will not insure.

- Size of the group: Some insurance providers will not implement group Long Term Disability for groups under a certain headcount, although there has been increasing flexibility in this area. For many small employers, they feel they cannot afford to offer more than a basic health and dental plan, or they do not feel the need to offer comprehensive coverage.

- Misperceptions: Many employers and employees fail to understand the importance of this coverage and may have incorrect assumptions regarding government programs.

From our perspective at the Immix Group, education in this area is key! While we don’t think twice about insuring our valuable physical possessions (our house, car, boat, jewellery), and most people understand the need for life insurance, disability coverage is too often overlooked.

A typical group Long Term Disability plan provides good coverage for most people

Firstly, let’s address group Long Term Disability coverage; it’s our belief that this should be included in all employee benefits programs. A typical group long term disability plan is set up as follows:

- 67% of monthly earnings to a maximum benefit amount (for example, $5,000 per month);

- A Non-Evidence Maximum (NEM) applies, which is the amount of coverage you can get without providing evidence of good health (for example, $3,000);

- Coverage (and potentially benefit payments) continue to age 65;

- A two-year ‘own occupation ‘period usually applies.

These limits are based on the group: average income, occupation, and overall size. Generally speaking, the larger the group and the higher the average income, the higher the NEM and Max Benefit.

Many people find themselves under-insured through a group Long Term Disability plan

For a percentage of groups (this varies greatly depending on the group) the higher earners find themselves underinsured through a group plan. While advisors can request for increases to the group limits, there are often outliers who simply cannot be adequately insured due to the limits the insurer imposes. Consider the following simplified example:

- Annual Income: $200,000 ($16,667 monthly gross, ~$10,000 net)

- Group Long Term Disability: $5,000 per month max

- Income Replacement Percentage: 50% ($5,000/$10,000)

- Shortfall: ~$5,000 per month

In the example above, the individual insured may have no idea they would be receiving only around half their pre-disability income; many people simply do not pay attention to the specific details of their coverage.

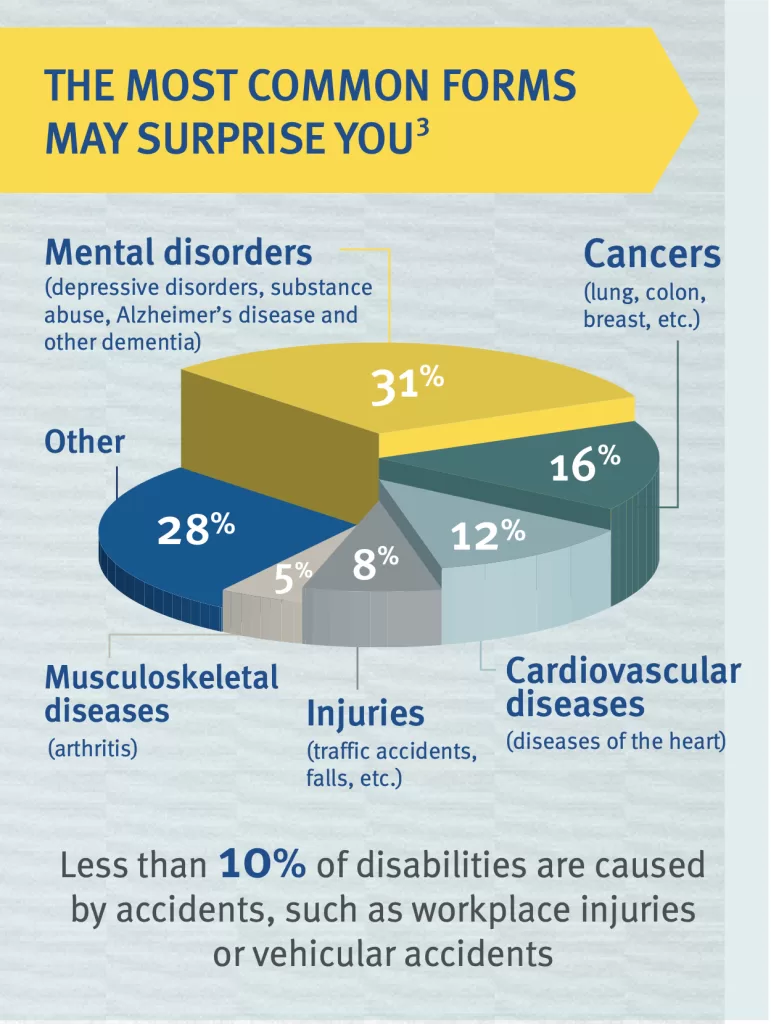

The most common types of claims? This may surprise you, but Mental Health claims are the largest category of disability claims.

Source: RBC Insurance. “Sales Resource Centre.” RBC Insurance, June 2024, www.rbcinsurance.com/salesresourcecentre/file-777224.pdf. Accessed 28 June 2024.

We strive to ensure HR personnel and other leadership are aware of potential shortfalls

At the Immix Group, we review the list of those with a disability shortfall at every program renewal; it’s important that those with shortfalls are aware they are not fully insured. It is the role of the plan administrator to ensure this information is clearly passed along to affected plan members. Individuals may be able to apply for amounts above their Non-Evidence Maximum, or they may wish to pursue a top-up disability plan. But the first step is ensuring the details are made clear to the member.

Bridging the gap with Individual Disability top-up plans

Many people seek out individual disability policies, and in fact, we assist with this every day.

For those with a shortfall in coverage, it’s important that plan administrators ensure they are presented with their options and assisted through the process by a qualified advisor.

Whether you are seeking an Individual Disability policy because you do not have access to a group plan, or you are seeking to “top-up” the coverage on your group Long Term Disability plan, the process is similar.

In contrast to a group disability plan, individual policies are usually fully underwritten which means a medical and financial assessment is made by the insurer. An exception is with Guaranteed Standard Issue group disability policies, which in short, is a group of individual policies issued to a group of qualifying employees, with limited underwriting.

What about Short Term Disability coverage?

A small percentage of companies provide insured Short Term Disability coverage, and some companies provide some form of in-house continuing income. However, this is not required and the majority of employers default to Government Employment Insurance Sickness Benefits for the duration of time prior to Long Term Disability benefits beginning.

Key differences with Individual Disability policies compared to group Long Term Disability plans

Beyond increasing the amount of coverage to ensure you are fully covered, there are many features available within individual policies that are superior to most standard group long term disability:

- Portability; The contract is not connected to your employment, you take it with you wherever your career takes you.

- Individually underwritten; this means the contract is customizable, to an extent. For example, a situation that would result in a “decline” of coverage over the non-evidence maximum under a group plan might be listed as an exclusion under an individual plan.

- Key riders: individual contracts often allow for popular and beneficial riders to be included:

- Future Income Option: this allows for your coverage to be increased as your income rises, without medical underwriting.

- Cost of Living Adjustment: this ensures your benefits during a claim are increased to keep pace with inflation.

- Controlled cost: Pricing is locked in for the duration of your contract, which is typically to age 65.

- Own Occupation to age 65: This means you are covered for your “own occupation” to age 65, and not for the typical 2-year duration (details below).

While in some circumstances these features can be included under group Long Term Disability plans, they are not common and are more costly to include.

The “definition of disability” is the most important feature of your plan

A certain “definition of disability” applies- in short, this is how the insurer will define what is considered “disabled”, and under what exact circumstances the contract will pay out to the sick or injured claimant. Very broadly (please note insurers differ):

- “Own Occupation” refers to being unable to perform all or the majority of the duties of your occupation

- “Any Occupation” refers to being unable to work in any capacity or at any job.

Under a typical group plan, the first two years of disability cover the insured person for their “own occupation.” After two years, the person is considered disabled based on meeting the definition of disability for “any occupation,” a more restrictive definition.

In contrast, many individual plans cover the insured person on an “own occupation” basis to age 65. This varies between plans, and availability varies based on the insured’s unique characteristics and occupational duties.

The wording used in the contract is crucial and differs between insurers; our role is to understand this and ensure that coverage is appropriate based on the unique needs of the group or individual.

Long Term Disability coverage is essential and needs to be understood

For the majority of people, the coverage through a group benefits program will provide them with income replacement to the allowable limits (you cannot be insured for greater than your pre-disability income), meaning they are adequately insured, with regards to the dollar amount of coverage in place.

But, as we have alluded to, the quality of the coverage requires a deeper dive, and one size does not fit all.

What should employee benefits plan administrators and HR personnel do?

Know the numbers– do shortfalls exist for your team? If so, to what extent? Can this be addressed adequately through the group insurer? Have you clearly communicated to each plan member the details of their group Long Term Disability coverage and ensure they understand how to apply up to the maximums available, whether this is through the Group Long Term Disability or through a top-up policy?

The Immix Group is here to help

Part of our role as Canadian benefits advisors involves analyzing and making recommendations on the appropriate Long Term Disability program for your company, and by extension, ensuring full coverage options are made available for the individuals within your organization. The Immix Group works with businesses and individuals across Canada and across all sectors. If you would like to ensure you or your team members are adequately covered, we invite you to reach out and engage with one of our qualified advisors to discuss your options. – we love to hear from you!

Contact Us: Immixgroup.ca or call us at (604) 688-5559.

Read More

The Power of Protection: Understanding the need for Living Benefits Insurance

– The importance of living benefits insurance: protect your financial stability in the face of illness or injury

Fewer Canadians have disability coverage through workplace benefits, leaving them more at risk

– Despite the risks, a significant number of Canadians lack disability coverage, facing financial vulnerability in case of disability

Disability: A Canadian Reality

– It’s more common than you think. Protect your most valuable asset – your ability to earn income.

Disabled Workers Face a Perfect Storm

– Canadians off work due to disability face a perfect storm.

Top 7 FAQs

Group LTD insurance is provided by employers and has set coverage limits and parameters. Individual disability insurance is personally obtained, customizable, portable, and not tied to employment.

Understanding your coverage is crucial because many people are under-insured and unaware of the shortfalls in their plan. This knowledge ensures you can address any gaps and be adequately protected financially in the event of a disability.

LTD insurance provides income replacement when you are unable to work due to a disability. Group plans typically cover 66.67% of monthly earnings up to a specified maximum, continuing until age 65, with a two-year ‘own occupation’ period followed by ‘any occupation’ criteria.

Common reasons include the cost of coverage, difficulty insuring certain industries, the size of the group, and misconceptions about the necessity and importance of LTD insurance.

Yes, you can have both. Individual policies can act as a top-up to ensure you have sufficient coverage beyond what is provided by your group plan.

Individual policies offer portability, customizable coverage, key riders like Future Income Option and Cost of Living Adjustment, controlled costs with locked-in pricing, and often an ‘own occupation’ definition until age 65.

Employers should clearly communicate the details of the group LTD coverage, identify any shortfalls, assist employees in applying for maximum coverage, and offer guidance on obtaining top-up policies if needed.

About Us:

Immix Group Employee Benefits Ltd., headquartered in Vancouver, British Columbia, is an independent employee benefits consulting firm with a history spanning over 30 years. Our client-centric approach has led to successful partnerships with over 400 employers across various sectors and regions.

With longstanding supplier relationships spanning decades, we collaborate closely with insurance and investment providers, fostering a culture of mutual respect. Our role is to partner with our clients in the design, implementation, and ongoing management of benefits programs. Our consistent engagement with HR personnel, financial and operational staff, and plan members guarantees exceptional service, comprehensive coverage, and sustainable costs.

Have any questions? Contact us at: info@immixgroup.ca or call us at (604) 688-5559 – we love to hear from you!

Disclaimer:

The Immix Group is an Employee Benefits firm based out in Vancouver, B.C. The information provided in this article is for general informational purposes only and is not intended as legal, financial, or professional advice. While we strive to ensure the accuracy and reliability of the information presented, we make no warranties or representations of any kind regarding its completeness, accuracy, or suitability for any particular purpose. Readers are encouraged to seek independent advice from qualified professionals regarding their specific circumstances. The authors and publishers of this article are not liable for any losses or damages arising from the use or reliance on the information provided.

Lindsay Byrka, CFP® BA, BEd

Vice President, Immix Group: An Employee Benefits Company

A Suite 450 – 888 Dunsmuir St. Vancouver V6C 3K4

O 604-688-5262