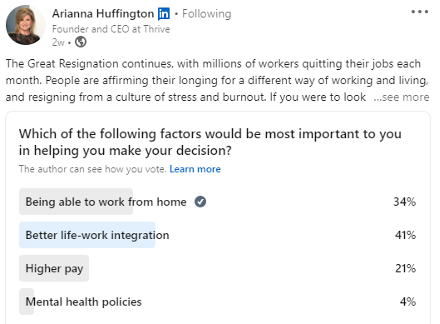

When selecting a benefits provider, ensuring the right match for your organization is essential. When it comes to the benefits offering, as we’ve spoken about before, ‘one size fits all’ is not an ideal approach to take. Different insurance carriers have various strengths and weaknesses. But what is the right match? What are the important factors to consider? How do you assess when it’s time to shop around?

It’s common to hear benefits advisors state that they ‘test the market every 3-5 years’ or within some other similar date range. At the Immix Group, we have a bit of a different take on this, as it’s our belief that switching carriers should be based on ongoing dissatisfaction in a key area:

- Service

- Systems

- Coverage

- Pricing

The desire to shop the plan with competing carriers can be driven by any of the above factors. Before we delve into each of these areas, we want to be clear: we certainly don’t think a benefits program should go without a frequent in-depth review. In fact, we conduct a thorough annual renewal review meeting as well as a mid-year update for all groups. Depending on your needs, this may include benchmarking, suggestions for plan design changes, analysis of program usage or other updates. In short, we are deeply involved on a routine basis in ensuring the smooth management of your program, the appropriateness of the coverage, the evolution of the benefits and adaptation to the changes your organization experiences.

As we say at the Immix Group, we want you to love your benefits plan! But what does that look like? To us, it means ongoing satisfaction in the areas we have named above. Sure, things go wrong sometimes. People make mistakes, systems and processes fail, or miscommunications can occur. While at the Immix Group we aim to prevent problems, a big part of our job is swiftly resolving issues that may arise. Sometimes, however, it’s time to make a move.

Exceptional Service, from both your advisory team and the carrier.

There is nothing more annoying than waiting on hold, other than waiting on hold and then not getting the answer you need! Unfortunately, one of the main complaints we hear is that insurance carriers fall short when it comes to the call centre support for employees and administrators. That said, some are better than others in this area.

We want those in our Client Community to come to us with questions rather than going directly to the carrier. Sometimes, this requires us to work behind the scenes with the carrier to obtain answers and resolve problems. There are also limitations due to privacy rules, but we do our very best to provide direct support at each level. Our partnered carriers are those with whom we have great confidence in their ability to deliver accurate and prompt assistance.

If you are feeling unsupported or employees are complaining, it’s important to examine where the service issues lie. Is it your broker or your provider? Where are the hiccups, and where does responsibility lie?

We often see instances of a switch in provider or advisor that is intended to solve an ongoing servicing issue but, unfortunately, the problem remains unresolved as there is a misunderstanding as to the true source of the issue. The most common service issues relate to claims not being adjudicated correctly or in a timely manner, unacceptable delays in obtaining information, or incorrect information being provided. If employees are complaining, it can be worthwhile to get an objective opinion from another advisor in order to assess where things are going wrong, before making a switch.

Systems and technology – these vary significantly between carriers.

To us, it is unacceptable in today’s world to not have information at your fingertips (i.e. on your phone)! The member application and online site, as well as the administrative portal, should be easy to navigate and provide the capability to complete most transactions online.

Additionally, insurance carriers today must be able to facilitate direct billing for most claims, which means providing software that makes it simple for pharmacies, dental offices, and other practitioner offices to engage with the program.

It is well established that the greatest indication of satisfaction with a benefits program comes down to the ease with which the member can interact with the plan. This means clear information as to what is covered, combined with simple and efficient claims adjudication. Ideally, the processing of the claim is directly at point of service, whether at the pharmacy, the dentist, or the chiropractor. The days of routinely mailing paper claims and waiting for a cheque should be far behind us.

Complaints related to systems tend to be connected to the inability to direct bill at a particular point of service or for certain types of items, difficult or manual processes for making employee changes, or overly complex billing statements.

Program coverage – not all carriers are identical in what they can provide.

Just as systems and service differ, carriers differ in the program coverage they will offer to a particular group. Sometimes a switch in carrier may be driven by the desire to access program features that are unavailable through your current provider.

When a program is being marketed and an ‘apples-to-apples’ quote is requested, there will always be deviations between carriers. For certain items, a carrier may be agreeable to matching what would normally fall outside their standard provisions (i.e. dental scaling units, specific non-evidence limits, or a unique paramedical practitioner reimbursement schedule); other items they may not match.

Any quote for coverage should also be examined carefully. Carriers do not “contract match” so there will always be minor deviations, even for what appears to be a comparable program. Carrier requirements and plan offerings differ in many areas, such as:

- Minimum number of employees

- Minimum number of employees to form a class of coverage

- Ability to structure the invoice (billing divisions, subtotalling etc.).

- Industry type they will insure

- Funding structures available to different types of groups

- Non-evidence limits and maximum benefit limits available

- Paramedical reasonable and customary limits

- Drug programs (available formularies vs open formularies)

- Long term disability provisions; cost of living adjustment, own occupation definition, definition of disability, non-evidence and maximums

- Health and wellness spending account availability and cost structure

- Network in specific areas; for example, some providers are more well known in certain regions compared to others

As well, providers vary considerably when it comes to embedded and optional services and programs. The list is long, but Employee and Family Assistance programs, virtual care, medical Second Opinion and drug management programs are commonly compared. It is important to consider who the third-party provider is for these programs and if the service is embedded or an additional cost.

If you are considering moving carriers because you believe your current provider is unable to provide adequate coverage in a certain area, we urge you to ensure this is accurate. Plan designs are highly customizable with most carriers.

That said, there are times when a particular group and provider are not a good match because of limitations in coverage offerings. For example, we have recommended a switch in carrier to access higher quality disability coverage, or because an employer was expanding from one province into multiple provinces. As always, working with a qualified advisor who understands the nuances of various providers will help guide you in whether a switch is the right move.

Benefit Plan Pricing- should you switch carriers to get lower rates?

High inflation has hit us all, and it is very possible you experienced an increased premium the last time your benefits program renewed.

You can almost always get a premium discount with a switch in carrier; however, a discount connected to a switch in carrier may be temporary. Unless you are reducing the administrative costs on the plan, which can be achieved in a variety of ways (membership in a pricing pool, reduced advisor commission, or elevated Target Loss Ratios, which may come from the previous two), you may just have a carrier ‘buying your business’ with an enticing price discount.

That said, benefits program pricing is complex and you really need to get into the details of how a new provider will price your program. Often the ability of your broker to negotiate or otherwise control the pricing (for example, through our broker-managed pools) is more important.

Comparing your claims to your premiums is a good indicator as to whether the discount is potentially sustainable, or whether it seems likely your premiums will increase at the expiration of the initial rate guarantee (assuming claims remain similar). For a typical insured non-refund plan, it cannot run at a loss year over year. This forecasting is tricky, and there is a good reason you should work with your benefits advisor to understand potential outcomes.

If you are otherwise happy with the provider, plan members are happy with the systems and the provider is able to support your desired program components, making a switch based solely on a short-term pricing discount may be shortsighted.

Moving carriers, while much easier today with advancements in technology and the ability to do mostly digital file transfers, is still disruptive to employees, including benefits admin staff and HR. Meetings, memos and training will need to occur to learn the new provider.

So, is it time to switch carriers, advisors, or both?

We are happy to market a program on your behalf, however, we need to truly understand why you wish to seek a different provider. We encourage you to think about the following:

- Service; we want to be clear on where the problem lies. Is it solvable?

- Systems; the ability to easily process claims is paramount, and comprehensive but simple systems are a must. Are there concerns in this area?

- Coverage; if you’re unhappy with the plan offering, can you work with your current provider to amend coverage or are they unable to support your desired program?

- Pricing; this is complex and it’s essential to be aware if a rate decrease appears temporary or sustainable.

Ultimately, our goal is to ensure that your program meets your needs at every level. Properly marketing a plan with appropriate alternative carriers and deep diving into the nuances of the coverage (especially for a more complex program), is a time-consuming endeavour for advisory groups, which we will gladly undertake.

Want a second opinion?

At the Immix Group, we offer a complimentary benefits program review which offers a detailed audit of your plan design, usage, rate history, and pricing. Our experts ensure your plan design is competitive and that your pricing is fair and reasonable in today’s evolving market.

Click the link to get a second look at your employee benefits package today!

Did you know?

The vast majority of the Immix Group’s new clients come as referrals from our existing clients! This is great news to us; this means our clients are happy with our service, their benefits program, and most importantly, they want to share this with a friend!

Key Takeaways:

- When to Consider a Change: Regular review of your benefits program is crucial, but switching carriers should be based on dissatisfaction in areas like service, systems, coverage, or pricing, rather than arbitrary timelines.

- Importance of Service and Systems: Effective communication and accessible technology are critical to employee satisfaction. Benefits programs should offer easy claim processing and responsive support to enhance the member experience.

- Understanding Pricing Dynamics: Navigating benefits pricing can be complex. It’s important to analyze your claims versus premiums to determine if a temporary discount from a new carrier is sustainable, rather than switching for short-term savings.

- In-Depth Reviews Matter: Regular, thorough evaluation of your benefits program can help identify gaps and ensure it remains competitive and sustainable in the face of rising costs, particularly with inflation impacting premiums.

FAQ

The right time to switch is when you experience dissatisfaction with service, outdated systems, insufficient coverage, or unfavourable pricing, rather than adhering to a fixed timeline.

Evaluate response times, accuracy of information, and overall support from both your advisor and the insurance carrier. Your satisfaction with claim processing is a good indicator.

Modern benefits providers should offer user-friendly online platforms and mobile apps that facilitate easy claim submission, access to information, and direct billing options.

While switching carriers can provide initial discounts, it’s important to evaluate whether those savings are sustainable and if the new plan meets your organization’s needs.

Switching carriers involves training and communication for employees and benefits administrators, which can be disruptive. Proper planning is essential to ensure a smooth transition.

Read More:

A Proven Strategy for Containing Employee Benefit Plan Costs – Latest News from Immix Group

8 Reasons for Increases to your Employee Benefit Plan Premiums – Latest News from Immix Group

Check to Ensure your Benefits Quote is Actually for a Comparable Plan – Latest News from Immix Group

EAPs – how these programs can benefit both employees and organizations

Lindsay Byrka BA, BEd, CFP

Vice President, Immix Group: An Employee Benefits Company

A Suite 450 – 888 Dunsmuir St. Vancouver V6C 3K4

O 604-688-5262