We write often about Group Savings Plans, as it’s our belief that one of the best ways employers can assist their employees is by offering them the opportunity to plan and save for the future.

This is a sentiment that is echoed by many in our industry. In their recent 2023 recap, iA’s Director of Plan Member Wellness and Education stated the need to evolve our thinking when it comes to group savings programs, and more specifically, to “develop engagement strategies that focus on supporting people to achieve their personal goals.”

Our interpretation of this comment is that your purpose in setting up a Group Savings Plan should extend beyond simply finding a way to provide more funds to your team, or setting up a plan just because you need to be competitive with similar employers. Employees are self-reporting that they are feeling significant stress, and the number one reason is due to finances. It goes without saying that everyone has many and varied personal goals related to achieving financial peace of mind.

The three reasons to implement a group savings plan we are focusing on here focus on these facts: the support is needed, the tactic is effective, and implementation is simple.

1. Employees need support when it comes to financial literacy training and tactics to get them on track in this area of their lives

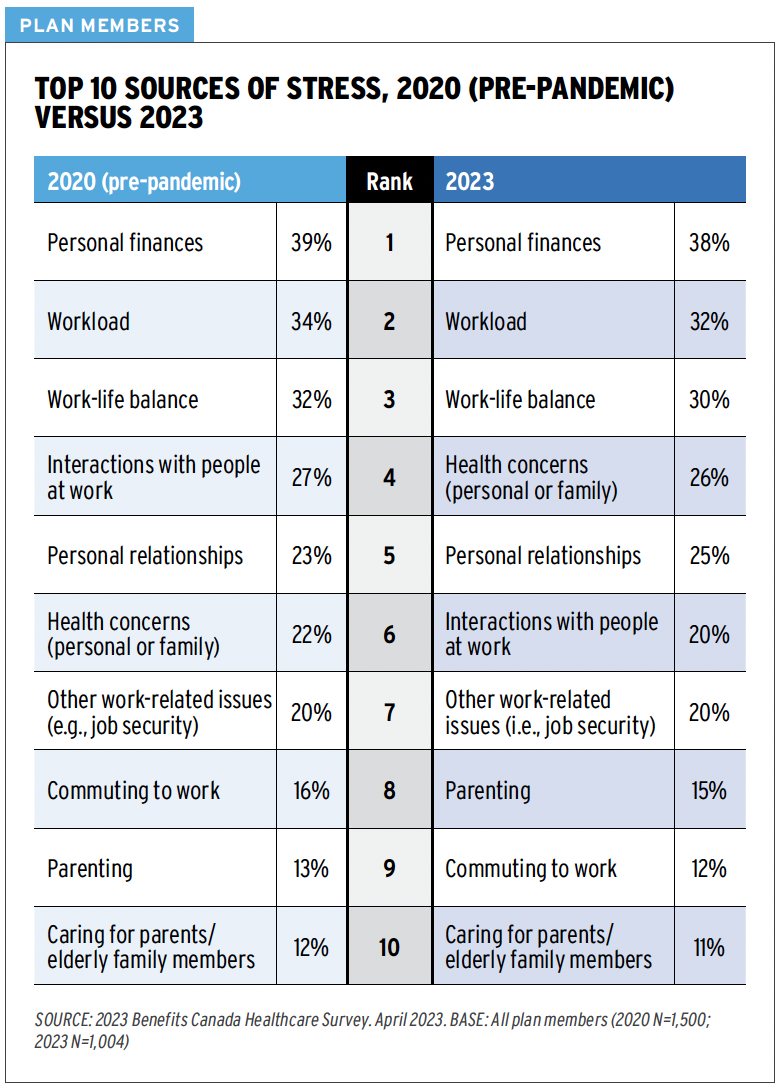

As we wrote about previously, a Group Savings Plan targets a key stressor for employees- their finances. The stats are clear, as reported via the 2023 Benefits Canada survey as well as through the Financial Consumer Agency of Canada:

- 32% of Canadians report feeling a high level of anxiety, stress, or worry over money.

- Only 49% of Canadians describe themselves as financially knowledgeable.

- 36% feel they are just getting by, financially speaking.

- 67% of Canadians said their debt increased by more than $5,000 in the past 12 months.

- 53% have an emergency fund (2023), down from 64% in 2019.

As the image from the Benefits Canada Survey shows, “Personal Finances” continues to rank #1, followed by Workload and Work-Life Balance.

The answer is not simply to ‘pay people more’. Equipping people with the ability to save in a systematic and tax-effective manner, and contributing to these savings through an Employer match goes a long way. Additionally, and most importantly, Group Savings Programs provide employees access to education resources, planning tools, and financial advisors that they may otherwise not bother to seek out. Access to financial advisors to help employees achieve their personal financial goals, even if it’s as simple as developing a budget to assist with living within one’s means, can create a lasting impact and potentially redirect the trajectory of one’s financial future.

Simply put, a Group Savings Program is an opportunity to assist your employees where they need it most.

2. It provides an immediate, twofold beneficial impact as savings grow and taxes are reduced

Contributions to an RRSP (Registered Retirement Savings Plan) reduce taxable income. The difference with a Group Savings Plan is that contributions are made directly via payroll deductions. When employees contribute to an RRSP directly from their paycheque, they experience income tax savings in real-time, as they are taxed on their after-contribution income.

We mentioned earlier the perspective that employers should seek strategies to assist employees in reaching their personal goals. Many employees identify financial goals, and particularly the development of a retirement savings account, as incredibly important.

Over time, and with engagement with the many planning tools available, an employer-sponsored program assists in creating a sense of achievement and tangible progress as retirement savings grow.

An added bonus? The Employer contribution. While not mandatory, this of course serves to boost an employee’s account value, taking them more quickly towards their goal.

3. Simple, low touch, high ROI

Lastly, it cannot be overstated how simple it can be to implement and manage a group savings plan. In contrast to the requirements of a pension plan, a simple group RRSP or group RRSP-DPSP combination plan is very low touch from an administrative perspective.

Even a very small employer can easily implement a Group Savings Plan that provides similar access to all the features (online platform, resources, investment funds, planning tools, etc.) that a much larger employer offer. It’s a way to recruit, retain, and remain competitive. In short, implementing a group savings plan provides a great return on investment.

Already have a group savings plan in place? Here are a few checkups:

- Have you taken advantage of our offer to host an education seminar?

- When was the last time you assessed the contribution level made by the Employer? Has it kept pace with inflation?

- When was the last time you reviewed Employee contribution levels? Have employees been reminded that they can increase their payroll deductions, again, to keep pace with inflation or changing circumstances?

- When did you last run an audit of participation levels? Is everyone who is eligible to participate enrolled?

- Are you aware of and communicating the many comprehensive resources available through your provider and advisor?

Help employees to save for the future

In summary, implementing a Group Savings Plan is a direct response to the financial stress reported by employees. Beyond immediate benefits like tax-effective contributions and employer matches, it offers a straightforward and high-return solution to recruit, retain, and stay competitive. By addressing employees’ financial concerns holistically, it not only eases stress but also fosters financial growth and supports personal goals.

At the Immix Group, we recognize the importance of financial literacy which is why we offer lunch and learn seminars where we explain, simplify, and guide our clients through their programs to help them maximize their benefits. Additionally, our clients have direct access to our sister company, Ciccone McKay Financial Group, where dedicated advisors are available and ready to provide personalized assistance.

It’s desired, it’s beneficial, and it’s simple to implement and administer! If it’s been on your mind to look into a plan for your employees, we’re happy to help you discuss options.

FAQ

Beyond just funding your team or competing with other employers, it addresses the top stressor reported by employees—financial concerns.

By enabling systematic savings and offering tax-effective contributions, it directly tackles the rising anxiety and lack of financial knowledge reported by Canadians. It also provides employees access to education resources, planning tools, and financial advisors that they may otherwise not bother to seek out.

It offers real-time income tax savings as contributions are made directly from paycheques, creating tangible progress toward personal financial goals.

While not mandatory, this of course serves to boost an employee’s account value, taking them more quickly towards their goal.

It’s simple, low-touch, and offers a high return on investment, making it easy for employers to implement and manage.

It requires minimal administrative effort, making it accessible even for small employers to provide features similar to larger employers.

Implementing a Group Savings Plan enhances competitiveness, contributing to employee satisfaction and loyalty.

Regularly assess Employer and Employee contributions, participation levels, and leverage available resources for ongoing plan success.