GSI

Guaranteed Standard Issue (GSI)

Disability Coverage

THE INCOME REPLACEMENT DILEMMA: DISABILITY COVERAGE AT EVERY INCOME LEVEL

If you have a comprehensive group benefits program, it likely includes long term disability (LTD) coverage. Your group plan probably provides good coverage for most employees. But higher earners- typically the key people at your company- often lack the coverage they need under a group plan.

The solution? Integrate individual disability coverage through a GSI program.

-

LONG TERM COST CONTAINMENT

GSI and Top-Up coverage have a fixed, locked-in cost. This means a smaller portion of the overall disability coverage is susceptible to annual pricing adjustments (i.e. the Group LTD rates).

Factors such as group demographics, economic changes and claiming trends all impact group LTD rates on a yearly basis. Unfortunately, Group LTD rates tend to increase, year over year. GSI programs help contain costs over the long term.

-

WHAT IS GUARANTEED STANDARD ISSUE?

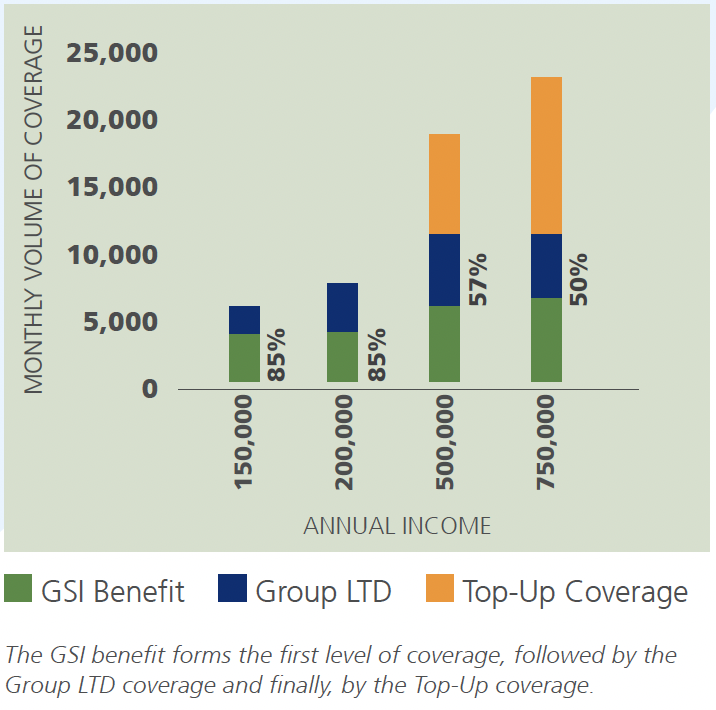

A Guaranteed Standard Issue disability program provides complementary coverage to an existing Group Long Term Disability plan.

GSI plans allow for groups to purchase individual disability policies at a significant premium discount, and without the onerous medical and financial underwriting associated with applying for an individual plan.

GSI adds an additional layer of insurance that provides greater coverage in the event of a disability. The rates are based on each individual and are guaranteed to remain unchanged. Additionally, a third layer of coverage (Individual Top-Up Plan) can be implemented when necessary to fully bridge the income replacement gap.

-

LONG TERM COST CONTAINMENT

EMPLOYERS

- Cost savings in the form of premium discounts and long term rate stability

- Competitive offering to attract and retain key people

- Ability to meet the income replacement needs of all employees

- Simple enrolment application and integrated billing with the group plan

EMPLOYEES

- Highest quality disability contract available in the marketplace

- Pricing discounts available and pricing is locked-in for the duration of the contract

- Portability of the contract (can retain plan, even if moving to another employer!)

- Limited underwriting means a simple approval process

REVERSE COMBINATION WITH TOP-UP

-

WHY DOES A COMPREHENSIVE DISABILITY PROGRAM MATTER?

Disability affects 1 in 3 Canadians before age 65. Unfortunately, disability is often misunderstood and insufficient coverage is in place.

Providing a program that offers all employees- at every income level- the opportunity to fully insure their income provides a more comprehensive and attractive overall disability package. A best-in-class disability program allows you, the employer, to set yourself apart from the competition, contain costs, and ensure peace of mind for both you and your employees.

Please call our office at 604-688-5559 for more information on how GSI coverage may be the right fit for your company.