Expanding into Canada? What Non-Canadian entities need to know when implementing an Employee Benefit program in Canada

Key Takeaways

- A typical employee benefits plan in Canada includes life insurance, extended health care, dental care, and often additional offerings like disability insurance, health spending accounts and retirement savings plans.

- The healthcare component of employee benefit programs is complementary to the coverage provided via provincial coverage, under Canada’s universal healthcare system.

- Navigating provincial regulations and employment standards is critical, making it important to work with licensed advisors who understand the Canadian market.

- Offering a robust benefits package is key to attracting and retaining skilled employees in Canada’s competitive job market.

- Customizing benefits to meet the specific needs of your Canadian workforce and industry will help ensure your company’s long-term success in Canada.

This year alone, the Immix Group, based out of Vancouver, British Columbia, has set up employee benefit programs for businesses head-officed in multiple countries around the world. Whether you’re in Australia, Singapore, Ireland, or the United States, there are key pieces of information to know if you are setting up a Canadian entity.

Companies are driven to expand into Canada by many factors including market opportunities, economic conditions, and strategic considerations. In particular, the highly educated, diverse workforce makes Canada an attractive location for companies, often at a lower cost than expansion to comparable locations.

To be competitive and successful in this expansion, companies must consider providing the right set of employee benefits for their Canadian employees. And this involves understanding the legal requirements and offering the right benefits. Here’s a list of key things to help you navigate the process:

The Basics: Canada has a Universal Healthcare System

Canada has universal healthcare, which is adjudicated provincially; this means coverage differs slightly depending on the province or territory of residence of your employees. All employees must be residents in order to qualify for provincial healthcare.

The reason this is important is that employer-sponsored extended health and dental programs may require provincial healthcare to be in place, as the two programs are complementary.

For most full-time permanent employees in skilled positions, the expectation is that the employer will provide an employee benefits program with a range of coverage. However, providing an employee benefits plan is not mandatory (please note the province of Quebec has special requirements) and coverage levels differ significantly from employer to employer. Many employers do not provide any extended benefits at all.

While not mandatory, a comprehensive benefits program is integral in attracting and retaining talent, and in protecting and promoting the well-being of employees.

What coverage does a typical Canada employee benefits plan include?

Within Canada, when one refers to their employee benefits plan, they are usually referring to the insurance package their employer sponsors, which is typically facilitated through a major insurance provider (Manulife, Sun Life, Canada Life, Blue Cross, RBC Insurance etc).

We will indicate the most basic components of an employee benefits program, followed by additional benefit offerings that comprise a more comprehensive offering.

The following are the core components of a group benefits plan:

Life Insurance

Life insurance amounts are usually either a small flat amount of coverage such as $25,000 or a salary-based benefit such as 1 x earnings, to a maximum. Higher amounts of coverage are usually extended to those in larger companies, or for more highly skilled professional firms employing those in more “white collar” occupations.

Accidental Death & Dismemberment (AD&D) is usually included alongside the Life insurance benefit, for the same amount of coverage.

For small groups, Life Insurance and AD&D are usually a very inexpensive component of the program, often running just a few dollars per employee, per month. The cost varies depending on the demographics of the group, and the overall volume insured.

Extended Health Care

As mentioned previously, Canada has universal health care. Extended Health Care is exactly that – an extension of the basic components provided through the provincial programs. Provincial healthcare is complex and differs across the country. The most simple way to understand what an employee benefits plan provides is to focus on the core components of a typical extended health care package:

- Prescription drugs

- Paramedical practitioners (massage, physiotherapy, chiropractor, naturopath, therapists etc).

- Vision Care (eye exams, contact lenses, glasses)

- Medical Equipment (orthotics, knee braces, crutches, wheelchair)

- Emergency Medical Travel Insurance

The categories listed above fall outside the scope of what is covered through our provincial health care, which provides coverage for doctor visits (including specialists), hospital care, surgeries, diagnostics etc. There are exceptions to all of the above, for example, for low-income households, children, or certain medications such as those dispensed in hospitals.

In short, while we have a robust universal healthcare system in Canada, many day-to-day routine medical expenses are not covered for average working people, and thus, an employer-sponsored group benefits program fills this gap.

A typical extended health care program will provide coverage for the areas listed above; where a plan becomes more competitive than another is based on the percentage of reimbursement and dollar limits included for various items. It is important to use a qualified advisor who knows the market in order to ensure you are providing a competitive program for your industry, size and location.

Dental Care

For most people, dental coverage comes via their employer program. It is not part of Canada’s universal healthcare system, although programs exist to provide dental coverage to low-income individuals (including the new Canadian Dental Care Plan).

A typical dental plan provides at minimum “basic” coverage which includes cleanings and routine maintenance procedures. The second level of coverage is for “major” dental, followed by a third level, for orthodontics.

It would be common to see a small employer provide only basic coverage, whereas a larger company, or those with highly skilled professionals on the higher end of the income spectrum, tend to provide better dental coverage.

In addition to the core components listed above, many programs provide:

- Long Term Disability insurance

- Short Term Disability insurance

- Critical Illness insurance

- Health & Wellness Spending Accounts

- Retirement Savings Plans

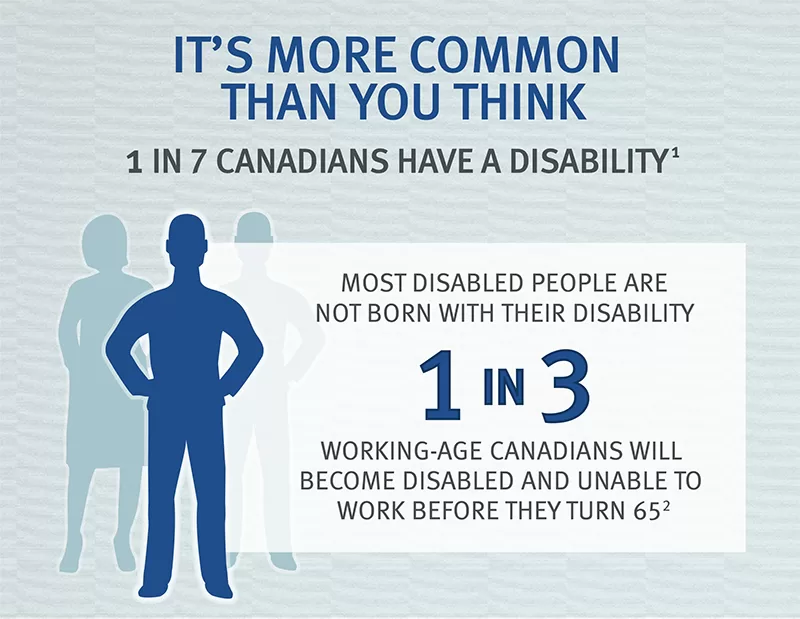

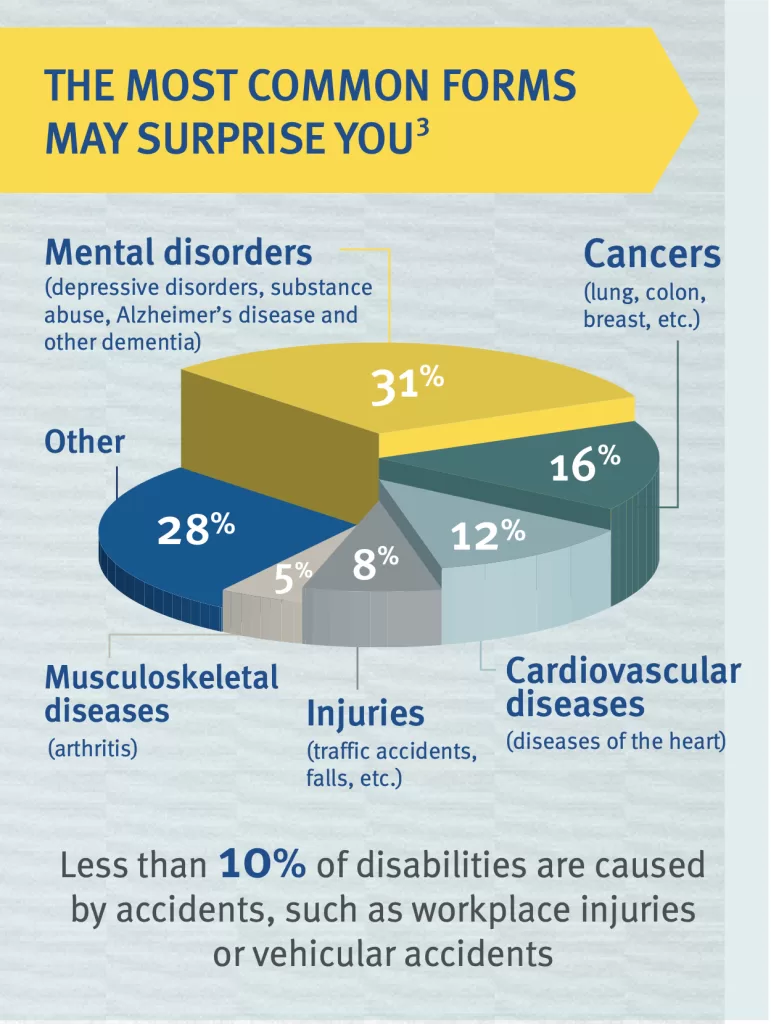

Long-Term Disability Insurance

Group Long Term Disability insurance provides salary continuance for those who are unable to work due to injury or illness and are therefore deemed “disabled” per the terms of their contract. Typically, Long Term Disability begins after 120-180 days of disability.

During these initial months, a person would be either on Short Term Disability coverage or would claim EI Sickness benefits through Service Canada (the federal government). This is a program that people pay into, as part of payroll taxes.

Many smaller employers do not provide group long-term disability insurance; they may not qualify to obtain this coverage, or they may choose to exclude it due to reasons such as cost.

Short-Term Disability Insurance

While most employers rely on Employment Insurance Sickness Benefits rather than insuring Short Term Disability, insuring this benefit does make sense in certain industries and for specific demographic profiles. Federal EI Sickness Benefits are 55% of weekly earnings to $668 per week (taxable, 2024 amount) so an obvious reason to insure this benefit is for greater coverage amounts that provide for greater income replacement levels. There are other advantages as well, which a qualified advisor can assist you in understanding.

Critical Illness Insurance

Critical Illness insurance provides a lump sum payment based on the diagnosis of one of the covered illnesses (cancer, heart attack, stroke, MS, for example). This is different than Long Term Disability insurance in that it provides a lump sum payment, rather than an ongoing income stream, and you can claim while still actively at work. Comprehensive programs often include this coverage in amounts ranging from ~$10K to $50K per employee.

Health & Wellness Spending Accounts

An extremely popular offering, Health & Wellness Spending Accounts provides a lump sum dollar amount to be used at the employee’s discretion, for health and/ or wellness expenses.

In Canada, Health Spending Accounts usually refer to non-taxable medical expenses that the Canada Revenue Agency lists as “eligible.” In contrast, Wellness or Lifestyle Spending Accounts cover other items related to fitness and lifestyle and are a taxable benefit to employees. The amounts extended to employees vary significantly between employers, but it is important to remember that a Health Spending Account is intended to supplement insurance, rather than replace it.

As HSA in the U.S (“Health Savings Account”) is commonly used, please note that HSA in Canada (Health SPENDING account) should not be used or googled interchangeably. They have some similar aspects but operate totally differently.

Group Retirement Savings Plans

Many employers provide their employees with Group Retirement Savings plans. In Canada, these typically take the form of a group Registered Retirement Savings Plan (RRSP), often in combination with a Deferred Profit Sharing Plan (DPSP). The purpose of these programs is to assist employees in saving for retirement, in a tax-advantaged way. The Immix Group has written extensively as to the benefits of group retirement savings plans for both employers and employees.

Also, please note that both the employer and employee contribute to the Canada Pension Plan (CPP) or Quebec Pension Plan (QPP). The contribution rates change annually. This is a mandatory payroll tax and would not be considered an ‘employee benefit’ here in Canada, although it does provide income in retirement.

Other Important Considerations

Maternity and Parental Leave

We are often asked about Canada’s well-known maternity and parental leave policies. In short, Employment Insurance (which provides for Sickness benefits) also provides benefits during maternity and parental leave. The formula used is the same, at 55% of weekly earnings, to a maximum ($668 per week, 2024). The choice of either 12 months or 18 months of leave is indicated upfront; you receive the same amount of total pay (i.e. if you choose the 18-month option, your payment is lower than under the 12-month option).

There is extensive information on the Service Canada website regarding EI Maternity and Parental benefits. There is very little involvement by the Employer in this matter; employees apply directly to Service Canada and are paid directly.

Additionally, some employers will provide ‘top-up’ pay for those on maternity leave either for a portion or for the entire duration of the leave. This practice varies significantly between employers.

Vacation / Paid Time Off

The Employment Standards legislation in each province and territory sets out the minimum legal requirements. In practice, many employers exceed these minimums when it comes to Paid Time Off. Depending on the province, employees may have minimum paid sick days as well; for example, in BC, employees are entitled to 5 paid sick days which is available to both part-time and full-time workers.

Workers’ Compensation Insurance (WCB):

Certain industries require employers to set up workers’ compensation insurance; this is managed at the provincial/ territorial level. Employers fund workers’ compensation through premiums. This program coordinates with other insurance; for example, an injury on the job would result in disability paid via worker’s compensation, rather than through the long-term disability insurance program.

Working with a Licensed Employee Benefits Advisor

Insurance providers require that Employers work with licensed insurance advisors in order to obtain pricing and implement and manage a group benefits program on an ongoing basis. In addition to being a requirement, employee benefits experts such as those at the Immix Group can advise you each step of the way. Advisors provide:

- Knowledge of Providers: Recommend reputable insurance providers and benefit administrators who operate in Canada. This often is part of the market survey process.

- Customize Benefits Package: Tailor the benefits package to align with the specific needs and preferences of your Canadian workforce. Consider utilizing templates from the advisory team to conduct surveys or interviews to understand the group’s priorities.

- Compliance with Collective Agreements: Ensure that your benefits package adheres to the regulations of the province(s) where your employees are based. Be aware of any collective agreements that may apply.

- Effective Communication: Having benefits is one thing, clearly communicating the benefits package to your Canadian employees is another. Provide written materials and in-person/online meetings explaining the benefits, enrollment procedures, and other relevant information.

- Smooth Enrollment Process: Implement an efficient enrollment process for Canadian employees. This could involve online portals, paper forms, or a combination of both.

- Training and Support: Offer training and support to your HR staff responsible for administering the benefits package. Ensure they understand Canadian regulations and can address employee inquiries.

- Regular Review and Updates: Periodically review the benefits package to keep it competitive and compliant with Canadian laws.

What do you need to get started?

When it comes to branching out into Canada, here are some key considerations:

- Are the employees Canadians or relocating to Canada?

- Is the company incorporated in Canada?

- Is Canadian payroll established?

- Do you have at least 1 or 2 employees already hired?

Expanding your business into Canada offers tremendous opportunities, but understanding the local landscape, particularly when it comes to employee benefits, is crucial. With Canada’s unique healthcare system, employment standards, and regional variations, it’s essential to work with experts who can guide you through the complexities. By aligning your offerings with the expectations of Canadian employees, you set a strong foundation for your company’s success in this new market.

If you’re ready to get started, our team at Immix Group is happy to help! Email us at info@immixgroup.ca or call us at (604) 688-5559. We love to hear from you!

FAQs

The first step is to determine whether your company is incorporated in Canada and whether you have established a Canadian payroll. This ensures compliance with Canadian regulations and allows you to provide benefits that meet local standards.

Canada’s universal healthcare system covers basic medical needs, but it does not cover services like prescription drugs, dental care, or vision care. Employer-sponsored benefits typically supplement these areas, providing additional coverage for employees.

A typical benefits plan in Canada includes life insurance, extended health care (covering prescription drugs, paramedical services, and more), dental care, and possibly long-term disability insurance and retirement savings plans.

Yes, there are regional variations in healthcare coverage and employment standards across Canada’s provinces and territories. It’s important to tailor your benefits program to align with the specific regulations and needs of employees in each province where you operate.

While it’s possible to offer a standard benefits plan, it’s often beneficial to customize the plan based on the specific needs of your Canadian workforce, industry, and location. Consulting with a local advisor can help you make these adjustments.

Licensed advisors are essential in helping you navigate the Canadian market. They recommend reputable insurance providers, ensure compliance with local regulations, customize your benefits package, and assist with effective communication and enrollment processes.

Clear communication is key to ensuring employees understand and appreciate their benefits. This can involve providing written materials, holding in-person or online meetings, and offering ongoing support to answer any questions your employees may have.

Read more:

Government of Canada – Employee Benefits Overview

Canada Life – Group Benefits for Employers

Prescription Drug Insurance | Régie de l’assurance maladie du Québec (RAMQ) (gouv.qc.ca)

How Does Workers Compensation Work in Canada? – Canadian Payroll Services

Manulife – Employee Benefits Solutions