Key Conversations in Employee Benefits

Lindsay Byrka, CFP® is Vice President at the Immix Group. She partners with employers to source and manage group life and health plans, and group savings and retirement plans, working with Canada’s leading insurers to support transparent pricing and flexible plan design.

LinkedIn

As we kick off 2026, we look back at the employee benefits conversations that shaped 2025 in Canada. Based on discussions with employers, carriers, and providers, certain themes stood out — from wellbeing and women’s health to cost pressures, flexibility, and financial wellness.

This article highlights the top trends and insights that dominated the year, showing how benefits continue to evolve toward more holistic, inclusive, and sustainable solutions for both employees and employers.

Weight Management as a Chronic Disease

We ended the year talking about weight-management medications — this was a dominant conversation with clients, advisors, and carriers throughout 2025, and one we expect to continue.

Prescription drugs for weight management were widely discussed by both our supplier partners and clients alike. We fielded questions from plan members asking how to access them and employers seeking guidance on coverage, risk, and long-term sustainability. In Canada, there are numerous approved weight loss medications available including:

- Wegovy (semaglutide)

- Saxenda (liraglutide)

- Mounjaro/ Zepbound (Tirzepatide)

- Contrave (naltrexone/bupropion)

- Xenical (orlistat)

But the conversation went far deeper than medications alone. Providers began addressing weight management head-on, recognizing it as a chronic disease and building supports that go well beyond “eat better and move more.” We saw a shift toward full-scope approaches — integrating clinical programs, nutrition counselling, mental health supports, and long-term behavior management — acknowledging the complexity and prevalence of this condition. With roughly one in three Canadians affected, it’s no longer viewed as only a lifestyle issue, it’s a medical condition that requires ongoing support and benefits designed accordingly.

At the Immix Group, we’ve been helping employers move towards meaningful, evidence-based support that improves outcomes while managing cost pressures.

Addressing Women’s Health through Employee Benefits

Women’s health continued to be a defining benefits conversation in 2025. Survey data this year showed that nearly half of organizations ranked women’s health as a top or high priority in benefits planning, with fertility and reproductive coverage increasingly seen as essential rather than optional.

Employers heard from plan members about gaps in coverage for fertility, reproductive care and mid‑life health, and that traditional plans weren’t keeping pace with real needs. Data from a 2025 RBC Insurance survey showed that three‑quarters of women say they want or need benefits that specifically support women’s health, including fertility and menopause services, highlighting persistent coverage shortfalls employers can no longer ignore.

In response, carriers and employers began evolving plan design and support. Insurers are expanding access to virtual care, reproductive resources, and wellness programs tailored to women’s needs, while employers are looking beyond core coverage to include supports that span family planning, pregnancy, postpartum care and hormonal health.

At the Immix Group, we’ve been encouraging employers to think holistically — integrating creative solutions like health and wellness spending accounts that cover childcare, lactation support, mid‑life therapies and mental health practitioners alongside traditional benefits.

We also highlighted the need for much stronger support for perimenopause and menopause — from hormone therapy and medical consultations to mental‑health support, menopause‑inclusive sick leave, and workplace awareness.

Women make up a large portion of the workforce, and without intentional design, benefit plans risk falling short on equity and effectiveness. By putting women’s health squarely in the center of benefits design, employers can build a more inclusive, supportive, and high‑performing workplace for everyone.

Flexibility, Personalization and Inclusivity in Benefits Plans

Flexibility, personalization, and inclusivity are increasingly a key factor in conversations around employee benefits in Canada. With Millennials (ages 29–44) and Gen Z (under 29) now representing over 50% of the workforce, employees are looking for benefits that feel relevant, adaptable, and reflective of their individual circumstances and life stages.

Employee benefits plans need to support a wide range of needs — from single young professionals, parents and caregivers, to LGBTQ+ employees and even retirees. While traditional group insurance remains the foundation for many employers, the focus is increasingly on ways to introduce meaningful choice and customization.

Modular or “flex” insurance plans are often discussed, and some products are available in the Canadian market such as the Equitable Life myFlex plan. However, these plans are less common for small and mid-sized employers because they can be costly to implement and complex to administer. Many providers will not offer true flex/ modular plans for groups under certain size thresholds, often 50–100 lives or more.

In the SMB space, flexibility is more commonly achieved through the inclusion of a Health and Wellness Spending Account to supplement the insured program. Health and Wellness Spending Accounts allow employees to use a predetermined annual allocation for the services and supports most important to them, whether that’s fitness, mental health, chronic condition management, or family care. This approach helps direct benefits dollars where they are most needed, increases perceived value, and improves employee satisfaction.

For Millennials and Gen Z especially, the desire for meaningful benefits is underscored by a desire for robust digital platforms that allow for intuitive, mobile device claiming and engagement. For employers, the challenge remains delivering comprehensive and inclusive benefits while keeping them cost-effective, sustainable, and manageable — a balance that is increasingly achievable as flexibility and personalization become central to benefits strategy.

Balancing Cost Pressures with Coverage Needs

Cost pressures were a frequent and defining theme in benefits conversations throughout 2025, particularly for small and mid-sized businesses. With inflation, wage pressures and rising operating costs continuing to strain budgets, SMB employers became more price sensitive than we’ve seen in recent memory.

Across the industry, we saw increased plan movement driven primarily by pricing — not by service failures or coverage gaps. Employers placed greater emphasis on rate stability, predictability and overall value, prompting more frequent plan reviews, marketing of plans, and discussions around alternative carriers and funding approaches. Through these processes, the Immix Group worked closely with employers to identify opportunities to maintain meaningful coverage while managing costs, including implementing thoughtful plan amendments where appropriate.

Our approach remains consistent: a focus on long-term value, cost sustainability, and thoughtful plan design — not short-term price chasing. Our broker-managed pools remain a solid strategy for small and mid-sized employers, offering plan flexibility, cost control, and lower administrative overhead.

Rather than responding to cost pressure by simply reducing coverage, we worked with employers to refine plans strategically: preserving high-value benefits, adjusting underutilized features, and layering in flexible tools such as Health and Wellness Spending Accounts where appropriate. A year defined by economic uncertainty and added cost pressure reinforced a principle we’ve long held: well-managed, thoughtful benefit structures — paired with proactive oversight — remain the most effective way for SMBs to balance affordability, stability, and employee wellbeing.

Group Savings Plans to Support Financial Well‑Being

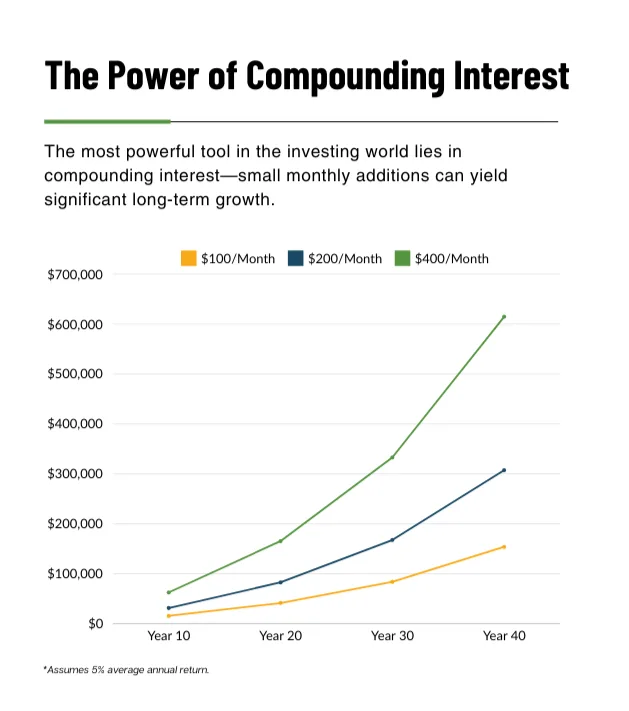

While employers focused on managing rising costs, employees simultaneously felt the effects of inflation in their day-to-day lives. In 2025, a prominent benefits conversations centered on financial stress and how employer Group Savings Programs can help employees to better manage their financial lives. With many Canadians citing personal finances as a leading source of anxiety, employers are looking beyond traditional health coverage to benefits that build financial resilience and confidence.

Group Savings Plans — including Group RRSPs, TFSAs and Deferred Profit‑Sharing Plans — are employer‑sponsored plans that help employees save systematically in a tax-advantaged way, often with lower fees, optional employer matching and access to professional advice.

But this year’s conversation wasn’t just about the savings vehicle itself — it was about the education and engagement that come with it. In fact, recent Capital Accumulator Plan updates included a greater emphasis on education for plan members, acknowledging that this is central to the success of these programs.

Financial stress doesn’t just affect bank accounts; it affects productivity, morale and retention. Reports show that employees experiencing financial stress are more likely to feel less productive, and 91% of employees say they’re more committed to employers who offer financial wellness supports like Group Savings Plans and on‑demand advice.

At the Immix Group, we’ve encouraged employers to treat Group Savings Plans as more than a retirement benefit — as a financial well-being strategy that includes planning tools, licensed advisors and ongoing education to help people feel in control of their money. These plans can help bridge the gap between financial worry and financial confidence, giving employees a clearer path toward goals like home ownership, debt reduction and long‑term security.

AI in Benefits — Reshaping the Industry

AI has been the headline story across every industry this year — and the benefits world is no exception. Canadian insurers now use AI to detect fraud, automate claims processing, and manage rising plan costs.

Industry groups like the CLHIA (the Canadian Life and Health Insurance Association, the national trade association for life and health insurers in Canada), are pooling anonymous data and applying AI analytics to catch suspicious patterns faster, helping protect plan affordability.

Insurance providers such as Manulife, Sun Life and Pacific Blue Cross are also using generative AI to interpret receipts, streamline adjudication, and speed up service — improving accuracy while reducing administrative strain. For employers, the takeaways are positive:

- Shared data boosts results. Industry-wide AI analytics catch patterns no single insurer could see alone.

- Efficiency is the payoff. Automated document and claim reviews reduce manual work and speed up service.

- Governance stays critical. AI needs human oversight, especially in adjudication and pricing decisions.

- Tech stacks are shifting. Carriers are investing heavily in AI, making intelligent automation a core part of future benefits administration.

As of 2025, AI is already embedded in how benefits plans operate. It’s enhancing efficiency and cost control, and it’s setting the stage for more personalized plan design. While this has been occurring quietly in the background in the benefits landscape, we expect AI integration to become more front and centre as we move into 2026.

Government Pharmacare Expansions Expected in 2026

Lastly, one of the most notable benefits discussions in 2025 centered on the planned expansions of national pharmacare in Canada. Looking ahead to 2026, these government initiatives mark a positive step toward broader access to essential medications.

In British Columbia, new agreements with the federal government aim to expand public coverage for eligible diabetes medications and supplies, including glucose monitors and test strips as well as hormone replacement therapy (HRT), with rollout expected early in the year (March/ April 2026).

These changes may be especially significant for small and medium-sized employers, who often face cost pressures in maintaining benefits programs, where drug claims can represent a major portion of claims. By shifting more medications over to public coverage, plan sponsors may see modest relief in spending, while employees will gain access to critical medications without out-of-pocket costs — a tangible step toward reducing healthcare inequities and supporting workforce health.

While the financial impacts may not be large or immediate for employers, this shift represents an early but meaningful move toward more truly universal healthcare in Canada, giving both plan members and employers reason to be cautiously optimistic.

Looking Ahead: Benefits that Support the Whole Employee

The underlying theme this year has been relevance and inclusivity: benefits that meet employees where they are, at every stage of life. Effective benefits go beyond coverage—they support employees’ whole lives, from health and wellbeing to financial security and flexibility.

At the Immix Group, we will continue to help employers take a proactive, thoughtful approach to designing benefit plans that are inclusive, meaningful, and financially sustainable. By focusing on long-term value, personalization, and strategic oversight, benefits can be a true driver of engagement, equity, and organizational resilience in an ever-changing landscape.

Key Takeaways

Benefits are getting more holistic and inclusive, cost oversight remains essential, and AI plus policy changes are reshaping plan sustainability.

Holistic and Inclusive Benefits Are Gaining Priority – Guided by advisors, employers are increasingly designing benefits that go beyond traditional health coverage, addressing weight management as a chronic disease, women’s health, financial wellness, and life-stage needs. Flexibility, personalization, and inclusivity are central to meeting diverse employee needs.

Cost Management and Strategic Oversight Remain Crucial – Small and mid-sized employers are balancing rising cost pressures with maintaining meaningful coverage. Including strategies like flexible Health and Wellness Spending Accounts helps sustain comprehensive benefits while controlling costs.

Technology and Policy Changes Are Reshaping Benefits – AI is quietly improving efficiency, fraud detection, and claims processing, while government pharmacare expansions promise broader access to essential medications. Together, these trends support long-term plan sustainability and equitable employee access.

FAQs

Quick answers to the questions employers and HR teams asked most often in 2025.

1) What defined employee benefits conversations in Canada in 2025?

2) Why has weight management become such a focus in benefits plans?

3) How are insurers and employers responding to gaps in women’s health benefits?

4) How are small and mid-sized employers balancing cost pressures?

5) How are Group Savings Plans supporting employees?

6) How is AI reshaping benefits administration?

Read More

Primary sources and Immix explainers referenced in this article.

-

Canadian employers increasingly prioritizing inclusive benefits: survey (Benefits Canada)

Highlights survey findings showing Canadian employers are putting more emphasis on inclusive benefits, with growing attention to evolving health and wellbeing needs.

-

Manulife ranks highest among life insurers for AI maturity in inaugural index (Insurance Business)

Reports on an AI maturity index that ranks Manulife highest among life insurers, reflecting how AI capability is becoming a competitive differentiator.

-

CLHIA taps AI to bolster financial stability, fight claims fraud (Insurance Business)

Covers how CLHIA is using AI to strengthen financial stability and help detect claims fraud, signalling faster modernization across the benefits industry.

-

Three in four women say benefits don’t meet their health needs (Benefits and Pensions Monitor)

Summarizes survey results suggesting many women feel workplace benefits do not fully meet their health needs, reinforcing demand for stronger life-stage support.

-

Government of Canada signs pharmacare agreement with British Columbia to improve universal access to free medications (Canada.ca)

Announces a federal–BC pharmacare agreement aimed at improving access to key medications and supplies, including diabetes and contraception coverage.

-

A generational portrait of Canada’s aging population from the 2021 Census (Statistics Canada)

Explains how Canada’s population is shifting by generation, helping employers anticipate changing workforce needs and plan design priorities.

-

myFlex – How it works (Equitable Life brochure PDF)

A practical overview of how a flexible benefits platform is structured and how members typically experience enrolment, choices, and ongoing use.

-

Managing obesity: a shared commitment (PDF)

Frames obesity as a chronic condition and outlines why long-term, coordinated support matters for health outcomes and plan sustainability.

-

HER-BC: Health and Economics Research on Midlife Women in BC (Women’s Health Research Institute)

Presents research on menopause-related transitions in BC, including barriers to care and impacts on work and daily living, with access to the HER-BC report.

-

Supporting Women at Every Stage: How Employee Benefits Can Make a Difference (Immix Group)

An Immix explainer on strengthening support across fertility, pregnancy, menopause, and other life stages through plan design and flexible tools.

-

Your Benefits, Your Way: The “101” on Health and Wellness Spending Accounts (Immix Group)

A plain-language guide to how Health and Wellness Spending Accounts work in Canada, and why employers use them for flexibility and predictable budgeting.

-

Hybrid Traditional + Flexible Employee Benefits: A Sample Design for SMBs (Immix Group)

Walks through an SMB-friendly design that pairs insured coverage with spending accounts to balance protection, flexibility, and cost control.

-

Financial Well-being: Valuable Resources through our Partnership with Ciccone McKay Financial Group (Immix Group)

Shares financial wellness resources and education options that can reduce employee stress and support better day-to-day decision-making.

Lindsay Byrka, CFP® BA, BEd

Vice President, Immix Group: An Employee Benefits Company

A Suite 450 – 888 Dunsmuir St. Vancouver V6C 3K4

O 604-688-5262

Latest Insights

Your One-Stop Guide: Exploring Key Themes in Employee Benefits

A Guide to Immix Insights Articles Are you wondering what we’ve been writing about? Perhaps you haven’t had time to read the articles, but you’re hoping to gain some information