It’s RRSP season in the world of benefits and financial services because as most of you know, the RRSP deadline is coming up!

As a reminder, contributions to RRSPs made in the first 60 days of the year can be applied to the previous year. In plain language, Canadians can reduce their taxable income for 2024 with RRSP contributions up to the RRSP deadline of March 3rd, 2025.

With this in mind, we wanted to provide some simple tips and suggestions for financial planning for employees at three stages in their career, and specifically, how these could be applied within a group savings plan.

Early career- just start saving!

For those in the early stages of their working life, the most important thing is to simply start saving, even if one can only manage a very small contribution.

We often recommend setting up two basic savings accounts- one designated as an ‘emergency/ opportunity’ account, and second, an investment account (Registered Retirement Savings Plan) to begin investing for the very long term.

Emergency/ Opportunity Account

A Tax-Free Savings Account works well for this purpose, especially something like a high-interest savings account which will grow steadily-rather than fluctuate- in case you need to withdraw the funds for an unexpected expense. This is ideal for unexpected situations (a vehicle repair) or opportunities (a special vacation) where you would not want to draw from long-term registered savings accounts or use a credit card.

Retirement Investment Account

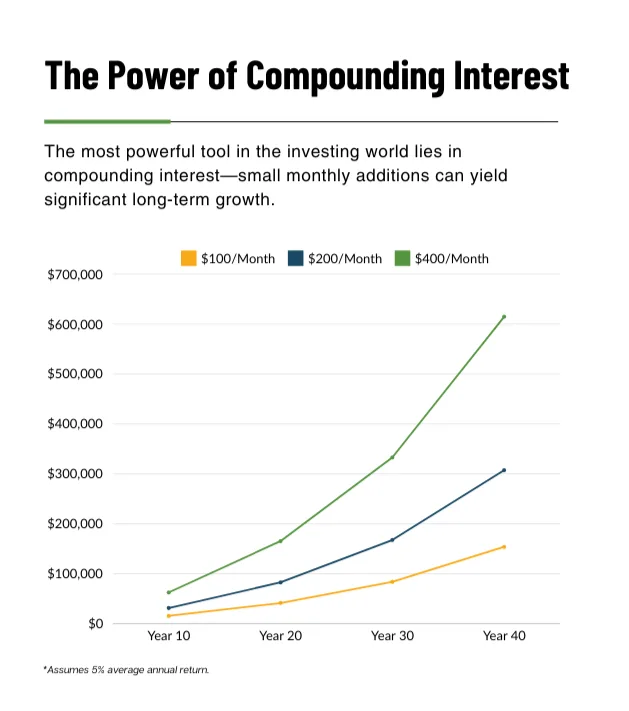

Along with this, and when possible, we recommend joining the Employer Group Savings Plan. Of course, within a Group RRSP, it’s optimal to do at least the minimum contribution to draw the full employer match available, but if that’s not financially possible, it’s beneficial to deposit even the smallest amounts, which will benefit from long-term compound interest.

If your younger employees are not eager to join the Group RRSP, it can be worthwhile to show them some of the key benefits such as the impact of long-term growth, and the tax advantages of a registered deposit. For most, a pre-tax payroll deduction is something that actually goes unnoticed!

Mid-career; it’s time to serious about planning, from a holistic perspective

For those who are more established in their careers and whose incomes (and families) may be growing, it’s time to really assess your short-, mid- and long-term goals in order to ensure you are on track.

Expenses are often very high at this point, and being strategic with tax planning, investing and insurance is paramount in order to set you up for retirement, even though it may be 2-3 decades away.

If it’s not something you’ve done already, this is the time to run projections in order to learn the specific steps and financial requirements needed to achieve your goals. Additionally, people in this stage of life often require greater amounts of insurance (life, critical illness and disability insurance, for example) to protect their families and assets.

Engaging with a qualified financial planner is the best way to ensure you are getting appropriate advice, but these days, there is also a plethora of information available online. Specifically, your benefits and group savings plan providers offer great education resource hubs.

When it comes to your group savings plan, if you’re not already doing so, this is the time to ensure you are maximizing the employer match. If you have taken the ‘set it and forget it’ approach with your investments, assessing not only your contribution amount in dollars but also your investment choice is essential.

Approaching retirement; review and refine

As you approach retirement, it’s important to have a clear sense of your financial position, as well as any insurance needs you may have. The emphasis during this phase is on finetuning.

Firstly, with regards to insurance, it’s important to be clear as to whether you will have health and dental coverage in retirement via your employer, or how you can obtain an individual plan, if there is no employer coverage after you are no longer actively at work. Additionally, insurance plays an important role in estate planning; speaking with a qualified advisor to assess your needs in this area is recommended.

When it comes to income in retirement, ideally, if you have taken proper steps to plan and save along the way, you will not find yourself playing catch up in the last years of your working life. In the last decade prior to retirement, it is time to really look in depth at the various sources of retirement income (CPP, OAS, RRSPs etc) and understand the numbers. What will you receive, and when? Do you need to make modifications to your goals or timelines? Do you have plans to change your residence, and how could a home sale factor into your planning? At this point, there is still time to make the necessary tweaks or implement revised strategies. It goes without saying, if you’re not taking advantage of an employer RRSP in full, this should be a priority.

Employers- what role can you play?

Remind your staff to pay attention to the amount they’re contributing, where the funds are allocated, and whether this aligns with their goals.

Many employees overlook naming a beneficiary for their registered accounts; this is important as the funds will transfer directly to this person in the event of the member’s passing.

Encourage staff to seek customized advice, that considers their unique situation and goals. If it is intimidating to reach out to a person, please keep in mind that support is accessible in various ways. Depending on their comfort level and desire for interaction, individuals can choose to access support online, by phone, email or in-person.

Why should Employers offer a Group Savings Plan?

If you’re not already offering your team a Group Savings Plan, it’s time to get started! There are so many reasons for Employers to implement an employee RRSP or DPSP. We have written an entire article on this, but here ere are a few key advantages:

- Tax-advantaged way to reward employees financially

- Provide a means to save for retirement

- Provide financial literacy support

- Reduce employee stress related to finances

- Retain qualified staff

- Be a competitive employer in a difficult hiring environment

If you’d like to get started, please reach out to the experts at the Immix Group via email at info@immixgroup.ca or by phone at (604) 688-5559!

Key Takeaways

- Start Early, Even Small Contributions Matter – Young employees should prioritize starting their savings journey, even with small amounts. Utilizing both a Tax-Free Savings Account (TFSA) for emergencies and a Group RRSP for long-term investments can establish good financial habits.

- Maximize Employer Contributions – Employees should take full advantage of their employer’s Group RRSP matching contributions. Not doing so leaves money on the table.

- Mid-Career Planning is Crucial – As employees advance in their careers and face growing financial responsibilities, they must strategically plan for short-, mid-, and long-term financial goals, optimize tax strategies, and review their insurance needs.

- Pre-Retirement Adjustments are Key – Those nearing retirement should closely analyze their expected income sources (CPP, OAS, RRSPs etc) and expenses, ensuring they are financially prepared. Reviewing insurance coverage and estate planning is equally important.

- Employers Play a Vital Role in Financial Wellness – Companies should encourage employees to actively manage their RRSPs, name beneficiaries, and seek professional advice. Offering a Group Savings Plan enhances financial literacy, reduces stress, and helps attract and retain talent.

Top 5 FAQs

Even small contributions benefit from long-term compound interest, significantly growing over time. Plus, RRSP contributions lower your taxable income, providing immediate financial benefits.

A Group RRSP often comes with employer matching contributions, which can significantly boost your retirement savings. Additionally, contributions are deducted pre-tax from payroll, making saving effortless.

Ideally, contribute enough to maximize your employer’s match. Beyond that, aim for a contribution that aligns with your long-term retirement goals, balancing it with other financial responsibilities.

Contributions reduce your taxable income, which can lower your tax bill or increase your tax refund. Additionally, investment growth inside an RRSP is tax-deferred until withdrawal, helping your money grow faster.

A Group RRSP helps employees save efficiently for retirement while reducing financial stress. Employers benefit by attracting and retaining top talent, offering financial wellness support, and gaining tax advantages.

Lindsay Byrka, CFP® BA, BEd

Vice President, Immix Group: An Employee Benefits Company

A Suite 450 – 888 Dunsmuir St. Vancouver V6C 3K4

O 604-688-5262

Latest Insights

Your One-Stop Guide: Exploring Key Themes in Employee Benefits

A Guide to Immix Insights Articles Are you wondering what we’ve been writing about? Perhaps you haven’t had time to read the articles, but you’re hoping to gain some information