If you’re a Canadian business owner looking to offer flexible, tax-effective coverage that empowers your team, an HSA could be the missing piece of your benefits offering.

In this guide, we’ll break down what an HSA is, how it works, and why businesses like yours are making it a staple in their employee benefits package.

Health and Wellness Spending Accounts are Increasing in Popularity

Most people have heard of Health Spending Accounts, which have become increasingly popular over the past decade or so, with around 40% of plans offering some form of HSA.

This is in response to multiple generations in the Canadian workforce and their diverse needs, the increasing desire for flexibility and choice, and the simplicity of offering this predictable-cost benefit.

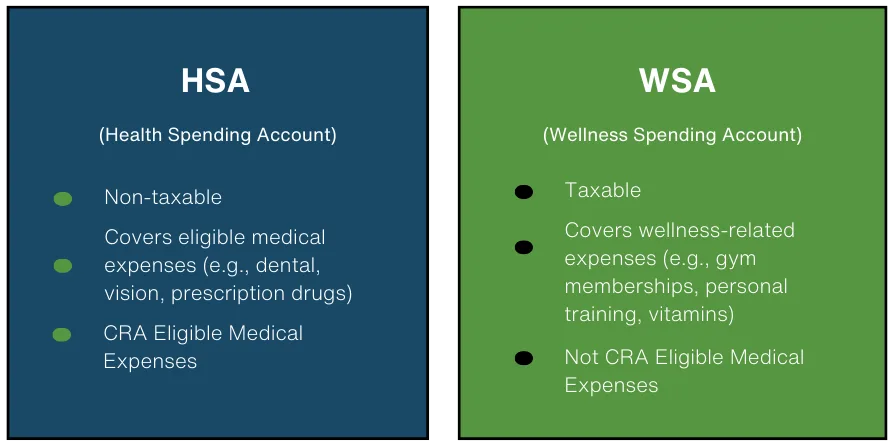

Most Canadian carriers now facilitate not only Health Spending Accounts (non-taxable, for items on the CRA’s Eligible Medical Expense listing) but also Wellness or Lifestyle Spending Accounts (taxable items that fall outside the CRA listing). In addition, many specialty providers offer robust, low-cost, user-friendly platforms for Health and Wellness Spending Accounts with many customizations available.

What is a Health Spending Account?

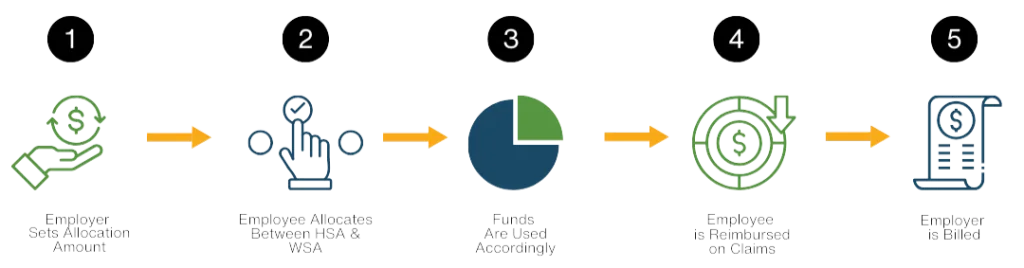

A Health Spending Account is set up by an Employer and provides a pre-determined annual allocation to an Employee, to be used for CRA-eligible medical expenses. Employees have the flexibility to choose which expenses are submitted through the Health Spending Account. Employees receive reimbursement for eligible claims on a tax-free basis. As the Employee uses their account, their available balance reduces.

Employers pay for the amount of the expense, plus an administrative charge for adjudication, and any applicable taxes on the admin fee. The total expense is tax-deductible to the Employer. To be CRA-compliant, Health Spending Accounts need to be facilitated via a third-party provider.

What is a Wellness Spending Account (WSA)?

Also known as a Lifestyle Spending Account (LSA), the primary difference from a Health Spending Account is WSAs/ LSAs are for taxable expenses (i.e. those not found under the CRA listing). The funding and cost for the Employers are the same as with a HSA, and Employers can also deduct the expense. The main difference is that expenses reimbursed through a Wellness/ Lifestyle Spending Account are a taxable benefit to Employees.

What is a Flexible Spending Account?

This simply refers to an account where the employee has both HSA and WSA reimbursement available. Typically, they can choose what percentage of the total allocation falls into each of the buckets (taxable or non-taxable) as described.

Collectively, many people refer to these accounts as “Health Spending Accounts” or “Health Care Spending Accounts” or by the American term “Health Savings Accounts,” although they may offer the ability to remit expenses under each tax bucket.

The Benefits: Why More Employers are Implementing Health Spending Accounts

From our perspective as benefits advisors, the answer to this is twofold: employees love Health Spending Accounts for the flexibility and choice, and employers find them cost-effective, simple and practical. The benefits are vast:

- Provides employees with choice and flexibility as to how benefit dollars are spent.

- Supplements insured benefits program reimbursement for example topping up an insured benefit item where a dollar limit has been reached.

- Cost control for employers; there is an upper limit per year and a defined admin fee, so no surprises!

- Ability to highly customize including with classes of coverage with varying levels of allocation.

- High value to invest in wellness programs, with research indicating 300-400% ROI.

- Tax advantaged as a fully deductible expense for employers.

What sorts of items can be covered through a Health Spending Account?

HSAs can cover a wide range of expenses as determined by the CRA Eligible Medical Expense Listing similar to traditional health benefits, including:

- Dental treatments and orthodontics

- Prescription drugs and medical devices

- Paramedical services like massage therapy, physiotherapy, and acupuncture

- Vision care, including glasses and laser eye surgery

- Medical equipment, supplies or surgeries

- Mental health practitioners

- Insurance premiums, deductibles and coinsurance from insured plans

Wellness Spending Accounts can cover nearly anything the employer desires! Common expenses include:

- Gym memberships, fitness classes

- Activity passes such as ski passes

- Children’s sports

- Childcare expenses

- Vitamins and supplements

- Fitness equipment

- Contributions to RRSPs

- Medical practitioners excluded by the CRA such as alternative health practitioners

Health Spending Accounts vs. Traditional Insured Benefits

At the Immix Group, we firmly believe that Health & Wellness Spending Accounts should be considered as a supplement to a more robust insurance program that offers coverage for prescription drugs, emergency out-of-country travel, dental, and other more catastrophic insurance coverage such as life, critical illness and disability.

With the defined dollar limit provided via a Health Spending Account, it works best as a supplement to provide flexibility and choice to a base insurance plan. In short:

Traditional Insured Plans:

- Pre-defined coverage with limits on certain services but typically covers catastrophic expenses at first dollar.

- Best for drugs, travel, disability, and items where true “insurance” is needed to guard against the unknown.

Health & Wellness Spending Accounts:

- Top-up insured programs where limits are in place, or cover un-insured items.

- Flexible spending based on individual needs.

- Allow reimbursement for wellness and lifestyle expenses not included through traditional insured benefits programs.

Key Features: With a Health Spending Account you can:

- Implement classes with different allocations available for different employee classifications.

- Allow one-year carry forward of unused balances (one year only, per CRA).

- Implement coinsurance (i.e. 50% reimbursement up to a total limit).

- Define the items covered within a Wellness Spending Account.

- Implement dedicated accounts to target specific areas (i.e. PPE account, Mental Health account, Childcare account).

- Easily pull reporting for tax purposes.

- Make changes to the allocation you provide at the start of each year.

A Predictable, Low-Cost Benefit for Employers

One of the main reasons employers are drawn to Health Spending Accounts is the cost predictability and transparency.

- Low administration cost, usually ranging from 3-10% on submitted expenses (plus applicable taxes on the admin charge only).

- Ability to change the offering each year, to adjust to budget constraints.

- Ability to implement ‘use it or lose’ rather than the ability to carry forward unused balances in order to have even greater cost predictability in a given period.

On average, employees typically spend around 60-70% of their allocated amount, making this a good estimate for employers looking to budget. Ultimately, the ‘worst case scenario’ (or best case scenario, depending on how you think about it!) is that all employees use 100% of their allocation.

A Hidden Perk: The Tax Advantage

Health & Wellness Spending Accounts aren’t just flexible — they’re smart.

- For Employers: Contributions are 100% tax-deductible

- For Employees: Reimbursements are tax-free for Health Spending Accounts

Although Wellness Spending Account reimbursements are a taxable benefit, most employees still see this as a huge perk as the cost of paying the tax on an expense is of course a small amount relative to paying out-of-pocket for the same item. For employers, providing funds via an HSA is less costly than the equivalent in salary.

What kind of Employer should implement a Health Spending Account?

The short answer? Every size of business, even a one-person incorporated company. While we do believe in providing a base insurance program to ensure proper protection against major expenses, there is a place for a Health Spending Account whether you are a two-person tech start-up in Vancouver British Columbia or a larger, established employer in Ontario.

Implementing a Health Spending Account can be a game-changer for:

- Small businesses that want flexible coverage and don’t yet have the budget for a traditional insured plan.

- Growing teams looking to offer competitive benefits.

- Companies with diverse needs where one-size-fits-all plans don’t cut it.

- Companies that want to customize their offering through targeted Health Spending Accounts.

How to Set Up a Health and Wellness Spending Account

First, you can set up a Health Spending Account with either a dedicated specialty provider (such as myHSA) or as an add-on to your program with your insured benefits provider.

An advantage of implementing a program with your insurance provider (for example Manulife, Sunlife, Pacific Blue Cross) is the ability to more seamlessly direct unpaid claim balances towards the Health Spending Account. However, insurance providers tend to be more costly and less flexible with account parameters.

Our preference is to work with a dedicated HSA provider.

Getting started is easier than you might think.

At the Immix Group, we help businesses build benefits plans that are clear, custom, and transparent — and that includes HSAs.

We help you to:

- Set a Budget: Choose how much you’ll contribute per employee on an annual basis.

- Establish Rules: Decide what expenses are eligible, and features such as whether to include the ability to carry forward unused balances, whether to allow employees to include expenses for dependents etc.

- Communicate Clearly: Educate your team on how to use their HSA effectively, in conjunction with any other benefits programs in place.

- Adjust as Need: Employees will submit expenses and be reimbursed, thereby reducing their available balance. The plan sponsor will have the ability to review the overall usage and make any changes to allocations or customizations, as needed (typically after the plan has been in place for one year).

Is an HSA Right for Your Business? Let’s Chat!

If you’re ready to explore how a Health & Wellness Spending Account can help you control costs while giving your team greater flexibility, we’re here to guide you. Reach out to us at info@immixgroup.ca or (604) 688-5559 – we love to hear from you!

Top 10 FAQs

An HSA is an employer-funded account that allows employees to be reimbursed for CRA-eligible medical expenses on a tax-free basis.

Employers allocate a set amount per year to employees, who then use it to cover eligible health expenses. Employers only pay for actual claims submitted, plus administrative fees.

A WSA (or LSA) covers taxable expenses such as gym memberships and wellness programs. Unlike an HSA, reimbursements are considered taxable income for employees.

While possible, HSAs are best used as a supplement to traditional benefits to provide more flexibility and customization.

Minimum amounts typically start at $250 per employee, with executive-level accounts often reaching tens of thousands per year.

Yes, all employer contributions to an HSA are 100% tax-deductible, making them a cost-effective way to provide benefits.

Employers can allow a one-year carry forward of unused balances, but beyond that, the funds expire as per CRA rules.

Any incorporated business can set up an HSA, including small businesses, self-employed individuals, and large companies. An HSA can be set up for just one person, but the business must be incorporated, and the individual must receive T4 income. Shareholders typically cannot participate.

Eligible expenses include dental treatments, prescription drugs, paramedical services, vision care, and medical equipment, among others.

Employers can set up an HSA through an insured benefits provider or a specialty provider, customizing rules and contribution levels as needed.

This restriction is due to compliance with CRA regulations, which require allocations to be determined in advance.

Key Takeaways

- HSAs Offer Flexibility & Choice

Employees can use HSAs for a wide range of medical expenses based on their individual needs, making them more adaptable than traditional one-size-fits-all benefits plans. - Cost Control & Predictability for Employers

Employers can set defined contribution limits, ensuring there are no surprise costs. The ability to adjust annual allocations or enforce a “use-it-or-lose-it” policy adds further financial control. - HSAs Are a Tax-Effective Way to Provide Benefits

Contributions are fully tax-deductible for employers, and reimbursements are tax-free for employees—making HSAs a more cost-efficient alternative to salary increases. - WSAs Can Boost Employee Engagement & Wellness

By covering wellness-related expenses like fitness memberships, mental health services, and even childcare, WSAs help promote employee well-being and work-life balance. - Combining HSAs & WSAs Maximizes Employee Satisfaction

Offering both allows employees to balance healthcare needs with lifestyle benefits, increasing overall satisfaction and retention. Employers can customize coverage to align with company culture. - Ideal for Small Businesses & Large Enterprises Alike

HSAs and WSAs are scalable solutions, benefiting businesses of all sizes—from startups looking for an alternative to traditional insurance to large corporations adding customization to their benefits package. - Implementation is Simple with the Right Provider

Employers can integrate an HSA/WSA into their benefits program seamlessly through an insurer or third-party provider, with many offering user-friendly digital platforms for easy claims processing. Using a third party ensures compliance with tax regulations, simplifies administration, and helps maintain proper documentation for CRA purposes.

Read more

- Hybrid Traditional + Flexible Employee Benefits: A Sample Design for SMBs

- 7 Ways to Plan for Your Health Spending Account Expenses

- 5 Surprising Ways to Use Your Wellness Spending Account

- How to Maximize your Benefits with myHSA

- How to Use Your Health & Wellness Spending Account for Preventive Care

- Your Guide to Health & Wellness Spending Accounts: What’s Covered and How to Make the Most of It

- Using myFlexplan to Help Provide Mental Health Benefits

- How myFlexplan and Traditional Benefits Work Together to Meet Employee Needs

- How to Build a Health and Wellness Strategy That Fits Any Budget

- Customizable Benefits for a Diverse Workforce: Why myFlexplan is Perfect for Small Businesses

- Setting up a Health and Wellness Spending Account

- Setting Up myHSA for Your Team

- Canadian Dental Care Plan expands to include millions of new eligible Canadians

Lindsay Byrka, CFP® BA, BEd

Vice President, Immix Group: An Employee Benefits Company

A Suite 450 – 888 Dunsmuir St. Vancouver V6C 3K4

O 604-688-5262

Latest Insights

Your One-Stop Guide: Exploring Key Themes in Employee Benefits

A Guide to Immix Insights Articles Are you wondering what we’ve been writing about? Perhaps you haven’t had time to read the articles, but you’re hoping to gain some information