Weight Management as a Benefits Priority: What Canadian Employers Need to Know

By Lindsay Byrka, CFP®, Vice President, Immix Group

About the author

Lindsay Byrka, CFP®

Vice President, Immix Group

Obesity in Canada: A Rising Concern for Employers

Excess weight and obesity now affect roughly one in three Canadians, a trend that continues to rise and presents growing challenges for both employees and employers seeking to foster a healthy workforce. Over the past couple of years, weight loss medications have come into the spotlight and at the Immix Group we have heard from employers and plan members seeking information on drugs from Ozempic to Saxenda and more. Not only is this a new FAQ for our team, it’s a topic of discussion with our supplier partners, as they navigate the inclusion or exclusion of these sought after medications. This raises an important question for organizations:“As an employer, what is the right and sustainable way to handle obesity and weight management in our benefits plan?”In recent years, insurance providers have begun to address weight management more directly, offering employers multi-pronged approaches that go beyond traditional “healthy living” campaigns. These initiatives now include targeted programs, therapies, and prescription medications for weight management, bringing the topic more openly into discussions about employee health.

Why Employers Should Think about Weight Management Within Benefits Programs

Supporting weight management in the workplace is more than a wellness initiative—it’s a strategic investment in employee health, productivity, and organizational culture. Nearly one in three Canadians is affected by excess weight or obesity, which the Canadian Medical Association (CMA) recognizes as a chronic, relapsing disease with complex causes, including genetics, environment, metabolism, and behaviour and not merely a lifestyle choice. This distinction matters because it underscores that obesity requires ongoing management, much like diabetes or hypertension, and has measurable implications for employers.The impact of obesity on the workplace is significant

Productivity and absenteeism: Obesity and related comorbidities are strongly linked to increased absenteeism and reduced productivity (presenteeism). Employees managing obesity-related conditions may need more time off or may be less able to perform at full capacity. Mental health: Employees living with obesity are more likely to experience stress, depression, and anxiety. Workplace stigma can exacerbate these mental health challenges, further affecting engagement and performance.Comorbidities and health costs: Obesity is associated with numerous chronic conditions, including:

- Type 2 diabetes

- Hypertension

- High cholesterol

- Fatty liver disease

- Heart disease

- Sleep apnea

- Certain cancers

- Depression and anxiety

Because chronic diseases drive significant costs in benefit plans, addressing obesity proactively can help control long-term healthcare spending, including both medical claims and drug coverage inflation.

Why it makes sense for employers to invest:

- It’s a chronic disease, not a personal failing: Recognizing obesity as a medical condition shifts the focus from blame to support, promoting an inclusive and compassionate workplace.

- Measurable ROI: Programs that help employees manage weight can reduce absenteeism, enhance productivity, and lower health-related costs over time.

- Culture and engagement: Supporting employee well-being—including weight management—demonstrates that the organization values health, inclusivity, and mental wellness. This can boost morale, retention, and overall workplace engagement.

Investing in weight management is therefore both a human and business imperative. By addressing obesity in a structured and supportive way, employers can help employees improve their health, mitigate chronic disease risks, and ultimately create a more productive and resilient workforce. Beyond the business case, it is an investment in employee wellbeing and reflects an organization’s commitment to being inclusive and caring.

Solutions for Employers: Supporting Weight Management Through Benefits

Effectively addressing weight management in the workplace requires a multi-faceted approach. Weight gain is influenced by numerous factors beyond diet and physical activity, including stress, genetics, medications, environmental conditions, and socio-economic circumstances. Employers who recognize these diverse influences and provide comprehensive benefits are better positioned to support employee health, productivity, and engagement.

Prescription Weight-Loss Medications

Prescription medications for chronic weight management have become an increasingly visible part of benefits discussions. While many group insurance contracts explicitly exclude anti-obesity drugs, employers can request coverage for these medications with some providers (usually at an additional cost).

The number of prescriptions for weight-loss drugs in Canada has grown dramatically: from 250,000 in 2019 to 2.7 million in 2023, an 82% annual increase, largely due to the wider availability of new medications. Costs are rising correspondingly, with weight-loss drugs representing a growing share of employer drug plans.

Key medications available in Canada include:

Weight loss medications work similarly to reduce appetite, increase feelings of fullness, and slow stomach emptying. Some work in the brain or digestive pathways.

- Saxenda (liraglutide) – GLP-1 receptor agonist, daily injection. Approved for chronic weight management since 2015. Similar to the diabetes drug Victoza but at a higher dose. Often available under employer drug plans.

- Mounjaro / Zepbound (tirzepatide) – Dual GIP/GLP-1 receptor agonist, weekly injection. These are the same molecule, but different brands. Zepbound is approved for chronic weight management and type 2 diabetes (as of July 2025) whereas Mounjaro is only approved by Health Canada for type-2 diabetes. Stated to produces more weight loss than Saxenda or Ozempic.

- Contrave (naltrexone + bupropion) – Oral medication, taken twice daily. Targets brain pathways affecting appetite and cravings. Approved for chronic weight management.

- Xenical (orlistat) – Lipase inhibitor, oral, taken three times daily with meals. Reduces fat absorption; gastrointestinal side effects possible. Approved for chronic weight management.

- Wegovy (semaglutide) – GLP-1 receptor agonist, weekly injection. Same active ingredient as Ozempic but approved specifically for chronic weight management.

- Ozempic (semaglutide) – GLP-1 receptor agonist, weekly injection. Approved for type 2 diabetes; often used off-label for weight loss but not approved for this use in Canada.

Ozempic is likely the most well-known of these drugs but it must be stressed that like others, it is not approved as a weight loss medication in Canada; it is a Special Authority Drug used in the treatment of Type 2 diabetes. Only those who are approved via the Special Authority process in BC are eligible for coverage for Ozempic.

Which weight loss drugs are covered by which insurance providers in Canada?

Like many aspects of an employee benefits program, the exact coverage under an employer plan depends on the plan design selected by the employer and the policy of insurer. Some providers have chosen to exclude specific drugs. Reasons vary, but generally, insurers will often exclude a drug if there is an alternative drug they feel has the same efficacy.

Obesity Canada states that fewer than 20% of private insurance plans cover obesity medications.

Coverage for these medications varies by plan and insurer, and access can be complex. Employers should work closely with their benefits advisory team to ensure there is clear understanding of options.

For example, RBC Insurance for October 2025 removed weight loss drugs as part of standard drug coverage, however they can still be included as an optional add-on. To include coverage they advised a 2.25% increase to EHC rates for $2K annual maximum reimbursement.

Pacific Blue Cross currently takes a similar approach, in that it is an add-on to a standard drug formulary.

These two insurers differ with the specific drugs they will cover, however, please note that we expect many changes in this area of benefits in upcoming years.

Non-Drug Supports: Supporting the Whole Person

Weight management is more than medication. Effective benefits programs integrate resources that address the physical, psychological, and lifestyle factors influencing weight. These may include:

- Paramedical services: Coverage for dietitians, psychologists/CBT, physiotherapists, and kinesiologists to support nutrition, emotional health, and physical activity.

- Employee and Family Assistance Programs (EFAP): Counseling, stress management, and resources for emotional eating or obesity-related challenges.

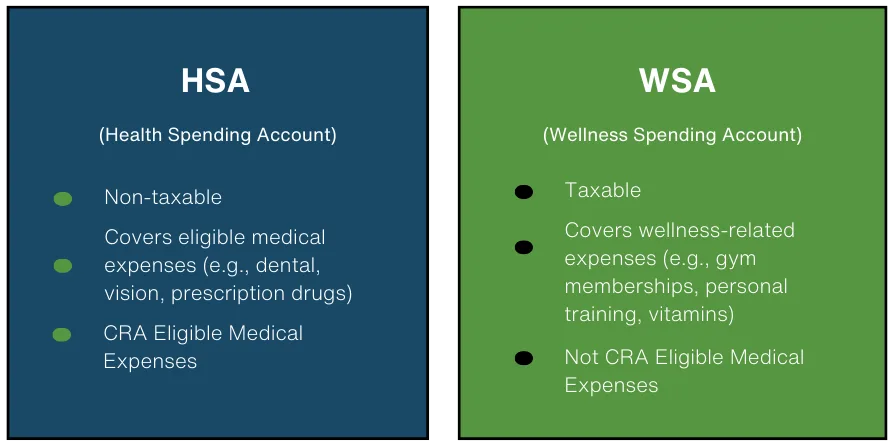

- Health spending accounts (HSA) or wellness accounts: Can be used for personal trainers, gym memberships, fitness equipment, or wellness programs.

- Equipment and medical supplies: Coverage for CPAP machines for sleep apnea, diabetes monitoring equipment, or other obesity-related medical devices.

- Healthy Living Rewards Programs: many programs exist or can be managed in-house to encourage and reward employees to make healthy choices. Step challenges, sleep or nutrition-based activities all can play a role.

By offering a comprehensive, multi-pronged benefits approach, employers can help employees manage weight safely and sustainably, reduce absenteeism and presenteeism, improve mental health, and support an inclusive, caring workplace culture. These strategies not only improve employee well-being but can also deliver measurable ROI by reducing chronic disease-related costs and supporting long-term productivity.

Solutions:

Effectively addressing weight in the workplace requires looking beyond diet and exercise alone. Numerous factors contribute to weight gain, including stress, genetics, medications, environmental influences, and socio-economic conditions. Recognizing these diverse influences is key to designing benefits that genuinely support employees’ health and well-being.

Plan design, risk and fairness: what employers should think about before deciding on weight loss drug coverage

At the Immix Group, our perspective is that employers should cover weight loss medications as part of a comprehensive benefits program. While there is a cost to including these drugs, it can be argued that supporting weight loss through medications can have a positive impact on overall health, especially considering the comorbidities that accompany obesity.

Balancing fairness, access, and plan sustainability

The cost of a benefits program can be a significant investment for businesses. By working with your advisor to thoughtfully design coverage, employers can:

- Support employee health with access to clinically approved therapies

- Reduce long-term health costs associated with obesity-related comorbidities

- Promote equity and inclusivity in their benefits offering

Insurer safeguards and clinical criteria

Making the decision as an employer to include obesity management medications does not mean that all employees will suddenly have full access to these drugs and therapies. Insurers commonly use prior authorization and clinical criteria to manage plan risk. These may include:

- Minimum BMI thresholds or documentation of weight-related comorbidities

- Verification of medical necessity by a healthcare provider

- Defined treatment plans or monitoring requirements

These safeguards help control costs while ensuring medications are used appropriately for those with a clinically recognized need.

As mentioned previously, currently fewer than 20% of plans include weight loss medications, despite the fact that obesity is recognized as a chronic, relapsing disease with significant health consequences. Our opinion at the Immix Group is that employers must tread carefully when choosing to exclude specific items, therapies or drugs. Structured, evidence-based coverage can strike a balance between access, fairness, and sustainability.

Communicating Weight-Management Benefits Thoughtfully: Tips for Employers

It’s important to remember that stigma surrounding obesity remains a serious concern. Many individuals who struggle with weight face misunderstandings or judgment that can negatively affect both their mental and physical health. A thoughtful benefits strategy must therefore balance effective interventions with support and sensitivity, creating an environment where employees can pursue healthier lifestyles without fear of bias or shame.

As employers consider how to support obesity management within their benefits program, communication must be clear, neutral, and sensitive. Because obesity is a chronic, relapsing condition, framing it as part of your broader health and chronic-disease strategy—rather than a lifestyle issue—is key to reducing stigma.

Consider the following, as you decide your approach as an employer:

- Use simple, respectful language such as “obesity management” or “clinically appropriate treatment,” and avoid framing weight as a matter of willpower or personal choice. Reinforce that your intention is to support employee health, not appearance.

- Be transparent about what is and isn’t covered, and why. Coverage depends on insurer policy, clinical criteria, and plan sustainability; explaining this context helps set expectations and ensures employees understand that decisions are made fairly and consistently.

- Privacy is essential. Clarify that accessing treatment is voluntary, confidential, and determined between the employee, their healthcare provider, and the insurer—not the employer.

- Finally, emphasize a whole-person approach. Weight is influenced by many factors, and support often extends beyond medication. Highlight available resources such as dietitians, psychologists, EFAP services, wellness or health spending accounts, and coverage for conditions linked to obesity. Positioning these supports together reinforces that your benefits program aims to meet employees where they are and provide meaningful, respectful care across the full spectrum of health needs.

Work with your advisor to develop an effective, thoughtful strategy

Addressing weight management within a benefits plan requires balancing employee health needs with plan sustainability, fairness, and evolving insurer policies. With obesity recognized as a chronic disease—and new therapies reshaping expectations—employers should consider a comprehensive approach that includes medication coverage, non-drug supports, and sensitive communication that reduces stigma and protects privacy. Because coverage options, clinical criteria, and cost impacts differ widely across insurers, employers should work closely with a knowledgeable benefits advisor. At the Immix Group, we help you navigate plan design, assess risks, and build an approach that supports employees while keeping your program sustainable.

Key takeaways:

- Obesity is a chronic disease affecting one in three Canadians and has significant workplace impacts, including absenteeism, mental health, and comorbidities.

- Supporting weight management through benefits is both a health and business strategy, improving productivity, engagement, and long-term costs.

- Coverage options vary widely by insurer and plan; prescription medications may be included as an optional add-on with clinical criteria.

- Non-drug supports—such as dietitians, mental-health resources, EFAP, and wellness accounts—are critical for a whole-person approach.

- Employers should work closely with a benefits advisor to design fair, sustainable, and inclusive weight-management programs.

FAQ’s:

Why should employers address weight management in their benefits plan?

Obesity is a chronic disease linked to productivity loss, absenteeism, mental health challenges, and comorbidities. Supporting employees’ weight management is both a health and business investment.

Which weight-management medications are available and covered in Canada?

Health Canada has approved drugs including Saxenda, Zepbound, Wegovy, Contrave, and Xenical for chronic weight management. Drugs such as Ozempic are approved by Health Canada only for type 2 diabetes; use for weight loss is off-label. Coverage varies by insurer and plan, often requiring prior authorization and clinical criteria.

Are weight-loss drugs included in most private insurance plans?

No. Fewer than 20% of Canadian private plans cover obesity medications, and coverage may require additional costs or optional plan add-ons.

What non-drug supports can employers provide for weight management?

Supports include dietitians, psychologists/CBT, physiotherapists, kinesiologists, EFAP services, health or wellness spending accounts, and coverage for obesity-related medical equipment.

How should employers communicate weight-management benefits to employees?

Use neutral, non-stigmatizing language, emphasize health rather than appearance, explain what is covered and why, maintain privacy, and highlight a whole-person approach.

Read More:

Managing your obesity | Obesity Canada

Obesity in adults: a clinical practice guideline | CMAJ

Managing Obesity: A Shared Commitment

Managing obesity: a shared commitment

Lindsay Byrka, CFP® BA, BEd

Vice President, Immix Group: An Employee Benefits Company

A Suite 450 – 888 Dunsmuir St. Vancouver V6C 3K4

O 604-688-5262

Latest Insights

Your One-Stop Guide: Exploring Key Themes in Employee Benefits

A Guide to Immix Insights Articles Are you wondering what we’ve been writing about? Perhaps you haven’t had time to read the articles, but you’re hoping to gain some information