Group Savings Plans: A More Tax-Efficient Way to Pay Employees

Lindsay Byrka, CFP® is Vice President at the Immix Group. She partners with employers to source and manage group life and health plans, and group savings and retirement plans, working with Canada’s leading insurers to support transparent pricing and flexible plan design. LinkedIn

When it comes to compensation, not all dollars are taxed the same. In many cases, contributing to a Group RRSP or DPSP delivers more value than paying the same amount as salary.

Tax-advantaged compensation: how SMBs can level the playing field.

In working with our SMB clients, this is a conversation that comes up quite often- how to compete with larger employers, but on a tighter budget. Employers find that strategically using tax-advantaged employee compensation such as contributions to a Group Savings Plan, can help to bridge the gap.

Registered plans continue to be one of the most effective financial planning tools in Canada, not only for individuals with personal Registered Retirement Savings Plans, but also for employers and employees participating in registered Group Savings Plans. For small and mid-sized businesses, Group Savings Plans can deliver meaningful tax advantages, often providing more value per compensation dollar than salary increases alone. This article explains how Group RRSPs and Group DPSPs work, and why their tax treatment makes them a practical and powerful part of an employer’s overall compensation strategy.

Why Group Savings Plans matter: the tax value of Group RRSPs and Group DPSPs.

Groups Savings and Retirement programs are a key part of a comprehensive benefits program. We’ve written extensively about the value of life, disability, mental health, dental, extended health and health and wellness spending accounts for employees, and a Group Savings Plan complements all of these.

When it comes to Group Savings Plans, particularly Group RRSPs and Group DPSPs, they deliver financial security, tax efficiency, and long-term value. From an employer perspective, these plans are not just retirement tools. They are high-impact, tax-efficient compensation strategies that support attraction, retention, and employee financial wellbeing — often at a lower cost than salary compensation.

Group RRSPs — Immediate, Visible Tax Value for Employees

What makes a Group RRSP valuable?

A Group Registered Retirement Savings Plan works much like an individual RRSP — but with one key difference: employee contributions are typically made through payroll, using pre-tax dollars. That small structural difference creates a much more visible and tangible benefit for employees. Employees see the benefit right away — on every paycheque — rather than waiting until tax time.

With payroll-based Group RRSP contributions:

- Contributions are taken before income tax is calculated

- Payroll withholds tax on a lower income amount

- Employees see the benefit immediately in higher take-home pay

Example of taxation of Group RRSP deposit via payroll deduction:

| Gross pay | $5,000 |

|---|---|

| Group RRSP contribution | $500 |

| Tax calculated on | $4,500 |

| Tax at 30% | $1,350 |

| Take-home pay | $3,150 |

Why a pre-tax contribution to a RRSP matters:

Employees do not have to wait months for a refund or remember to claim a deduction when they file their personal income taxes. The tax benefit is automatic, immediate, and easy to understand — which significantly increases perceived value. In contrast, with a regular after-tax contribution to a personal RRSP, income tax is applied to the full salary, and the contribution to the RRSP is with after-tax dollars.

Example of taxation of a personal RRSP contribution, after-tax:

| Gross pay | $5,000 |

|---|---|

| Tax is calculated on | $5,000 |

| Tax at 30% | $1,500 |

| Take-home pay | $3,500 |

| Contribution of $500 to a personal RRSP, leaving | $3,000 |

| At tax time, taxable income is reduced by | $500 |

So what is the difference with a personal after-tax RRSP deposit?

- Taxable income is not reduced during the year

- The RRSP deduction is claimed when filing your tax return

- The tax benefit is received later, usually as a refund or reduced balance owing

- Same total deduction eventually, but more tax is temporarily paid during the year

Pre-tax payroll contributions improve cash flow and participation in saving for retirement

While the long-term tax savings of a Group RRSP and a personal RRSP are ultimately the same, cash flow during the year is notably better with a Group RRSP. In the example above, the person had an extra $150 to use, despite the same gross pay and contribution to the RRSP.

Why higher cashflow matters

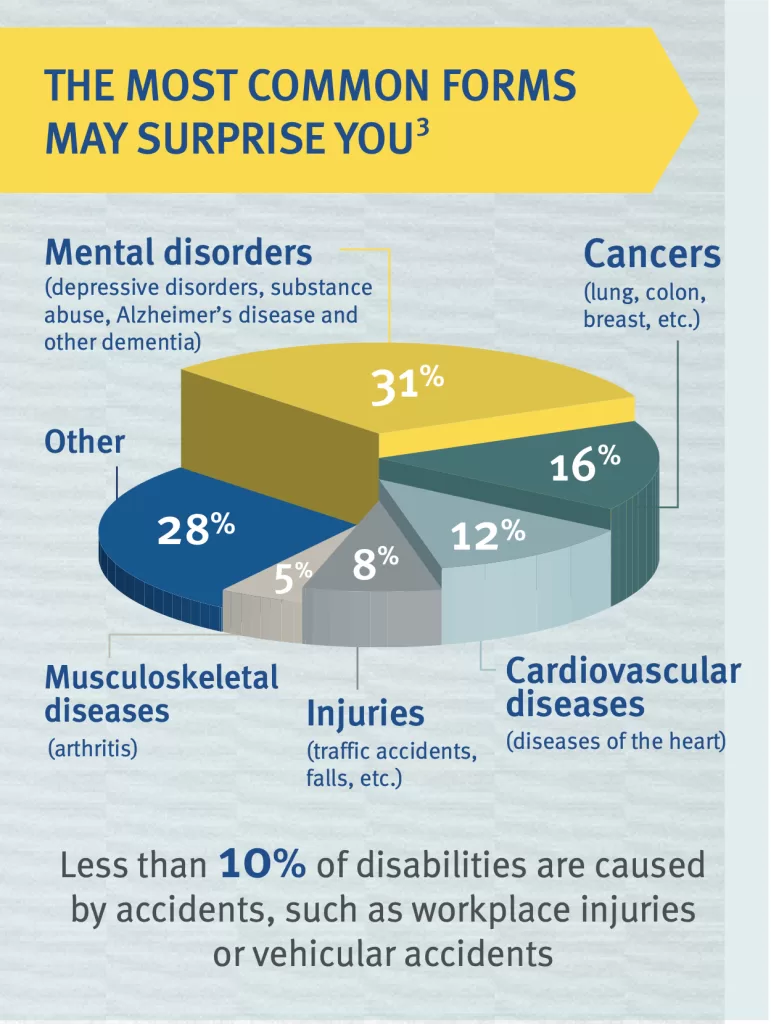

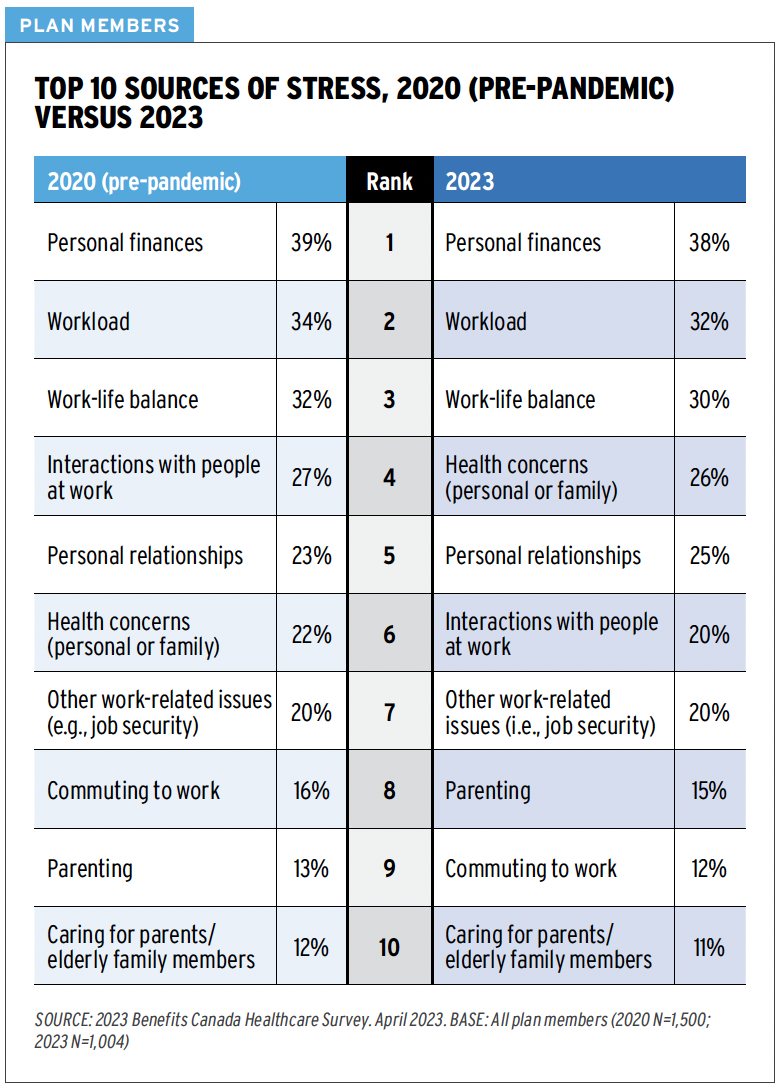

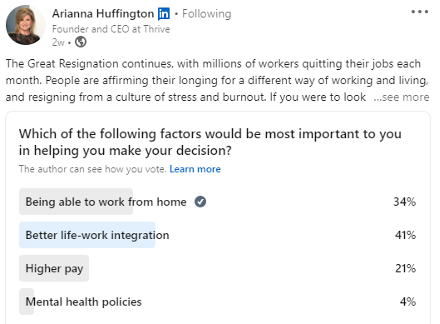

Employees are far more likely to save — and save consistently — when contributions feel more affordable and automatic. Pre-tax payroll deductions become a forgotten thing and make retirement saving feel achievable. As we have written about, financial worry is the number one source of stress for employees; making it easy goes a long way.

Employer contributions to a Group RRSP

Employer contributions to a Group RRSP via an employer match can feel like “free money” for the employee. Whether the contribution comes as percentage of salary, a match attached to the employee’s contribution or simply a flat dollar amount, an employer deposit helps boost retirement savings.

Employer contributions:

- Are taxable as income and draw CPP (defined as pensionable earnings)

- Are not subject to EI if the plan is set up to restrict withdrawals until retirement

- EI would apply if withdrawals are allowed, as the CRA considers this a cash benefit. The exception is withdrawals under the Home Buyer’s Plan or Lifelong Learning Plan.

- Are deductible business expenses for Employers

- Help boost retirement savings, growing tax-deferred inside the plan.

Why Group RRSPs are attractive for Employers

Employer RRSP contributions are highly visible, highly valued, and strongly associated with employer commitment to long-term employee wellbeing. Although taxable, compared to cash bonuses or salary increases, Group RRSPs can deliver greater perceived value to employees. They help reinforce a culture of financial wellbeing, allowing for the built-in delivery of education and financial wellness tools.

Deferred Profit-Sharing Plan (DPSPs) —One of the most tax-efficient compensation tools available

A Deferred Profit-Sharing Plan (DPSP) is an employer-funded group savings plan designed to share business success with employees. This is typically paired with a Group RRSP, which holds the employee’s contributions. DPSPs are not complex; they are set up alongside Group RRSPs through the same provider and hold the Employer’s contribution.

Key features of a Group Deferred Profit-Sharing Plan:

- Only the Employer can contribute

- Contributions are often tied to profits or a formula like percentage of salary

- Funds grow tax-deferred

- Frequently paired with a Group RRSP to hold the Employee’s contribution

- Allows for inclusion of vesting period up to 2 years

Employer DPSP contributions:

- DSPS contributions are not taxed as income

- Are not subject to income tax, CPP/QPP, or EI

- Like RRSPs, DPSP contributions reduce RRSP contribution room

- Appear as a Pension Adjustment (PA) on the T4

Just like RRSPs, DPSPs are a powerful retirement savings tool:

- Investment growth is tax-deferred

- Withdrawals (ideally in retirement) are taxed as income

- Withdrawals can be transferred to other registered plans (RRSPs), for example when leaving the group

In addition to the tax advantages of DPSPs, an important feature for Employers is the ability to including a vesting period up to 2 years. This means than employees are not able to withdraw from this employer-funded plan until the funds are vested. DPSPs rules help support retention while still delivering real value.

From an employer perspective, DPSPs:

- Are fully tax-deductible

- Avoid payroll taxes

- Allow vesting and forfeiture provisions

- Ability to align rewards with company performance

A DPSP is one of the most tax-efficient forms of compensation in Canada: no tax today, no payroll deductions, tax-deferred growth, and tax paid later when withdrawn, like other registered plans. They are one of the most cost-effective ways to deliver meaningful compensation. The bottom line- DPSPs are a high-value benefits that work for both sides.

Group RRSPs and Group DPSPs are more than retirement plans — they are strategic, tax-efficient compensation tools.

Together, they represent one of the most effective ways employers can support financial wellbeing while maximizing the impact of every compensation dollar.

“This is one of the most common ‘aha’ moments for small business owners. Once they see how much compensation value gets lost to tax when paid as salary, they realize Group Savings Plans aren’t just a benefit — they’re a more tax-efficient way to pay people.”

Wondering what the right set-up is for your company? A short review by an experience advisor like those of us at the Immix Group can show which structure makes the most sense for your team and budget.

Why Investments inside a Registered Group Savings Plans make sense for retirement planning

All investment growth inside registered investments is tax-deferred, accelerating long term outcomes:

- No tax on interest, dividends, or capital gains while funds remain in the plan

- This allows for faster compounding compared to taxable accounts

Employees pay tax only when funds are withdrawn — typically in retirement, when income and tax rates are often lower. A question commonly raised: “If I pay tax later anyway, what’s the point?”

The answer is simple: you’re deferring tax from your highest-earning years to lower-income years, while allowing your money to grow uninterrupted in the meantime. In short, RRSPs are a tool for income smoothing:

- Contribute during peak earning years

- Withdraw in retirement or lower-income periods

- Pay tax at a lower marginal rate overall

This principle is what makes registered investments such an effective long-term planning vehicle and why RRSPs (both personal and group plans) remain a cornerstone in financial planning. When compounded with the ‘free money’ aspect that comes with an employer sponsored group plan with a contribution match in place, it provides even better growth potential.

A simple client story: turning a pay raise problem into a better solution

The challenge: A growing professional services firm with 18 employees was feeling pressure to increase compensation. Several team members had been approached by larger competitors offering higher salaries and signing bonuses.

The owner wanted to respond, but a straight salary increase felt inefficient. When considering taxes, the business would need to spend significantly more just to deliver a modest increase in employees’ take-home pay. They said: “We wanted to do right by our team, but every dollar of salary felt like it shrank before it reached them.”

When compensation is paid as salary, the real cost of a raise is higher than it appears.

The solution. Instead of increasing base pay, the firm directed funds averaging $2,500 per year per employee to a Group Savings Plan. They introduced:

- A Group RRSP with contributions via payroll deductions

- An employer matching formula, stepped as tenure increased

- A Deferred Profit-Sharing Plan (DPSP) to hold these employer contributions

The same initial budget of ~$45,000 earmarked for salary increases was redirected into a tax-advantaged structure.

The result of implementing a Group Savings Plan instead of pay raises:

- Employees benefited from immediate tax savings through pre-tax RRSP contributions

- Employer DPSP contributions avoided CPP and EI, with all contribution dollars going to retirement savings.

- The program delivered greater perceived value than a salary increase

As a voluntary program, participation exceeded 85% within the first few months with employees describing the Group Savings Program as delivering “real” and “meaningful” value. And the owner felt confident competing with other employers by spelling out the clear financial benefits of the program to the team and prospective hires.

Curious how this could work for your business? We regularly model different Group RRSP and DPSP structures so employers can see real numbers before making a decision.

A smarter compensation structure can deliver more value without higher costs.

Thinking differently about compensation can unlock significantly more value for both employers and employees—without increasing overall payroll costs. Group RRSPs and DPSPs allow businesses to stretch compensation dollars further through tax efficiency, while supporting retention, financial wellbeing, and long-term savings. If you’d like to see how a Group Savings Plan could work for your team, a quick review with an experienced advisor can help you identify the most effective structure for your budget and goals.

Key takeaways

- Not all compensation dollars are taxed the same, and Group Savings Plans often deliver more value than salary.

- Group RRSPs make saving easier and more visible by using pre-tax payroll deductions instead of after-tax contributions.

- DPSPs are one of the most tax-efficient ways for employers to help employees grow their retirement savings, avoiding income tax, CPP, and EI at the time of contribution.

- Group Savings Plans help SMBs compete with larger employers by improving attraction, retention, and perceived compensation value.

- Group Savings Plans support long-term financial wellbeing, reducing financial stress and encouraging consistent retirement saving.

FAQs

Are employer contributions to Group RRSPs and DPSPs tax-deductible?

Yes. Employer contributions to both Group RRSPs and DPSPs are deductible business expenses, just like salary or bonuses.

Do employer contributions trigger payroll taxes like CPP or EI?

This depends where they are deposited and the plan set-up. Group RRSP employer contributions are taxable to the employee and subject to CPP, but typically not EI if withdrawals are restricted until retirement. DPSP contributions are not subject to income tax, CPP, or EI at the time of contribution.

How are employer contributions reported on the employee’s T4?

Group RRSP employer contributions are reported as taxable income (Box 40). DPSP contributions are not included in income but are reported as a Pension Adjustment (PA, Box 52), which reduces the employee’s RRSP room.

What happens tax-wise when an employee leaves the company?

Group RRSP balances belong to the employee and can usually be transferred to a personal RRSP- the funds stay registered, to continue growing on a tax-deferred basis. DPSP balances may be subject to vesting rules, but once vested, they can also be transferred to another registered plan without immediate tax.

Read more:

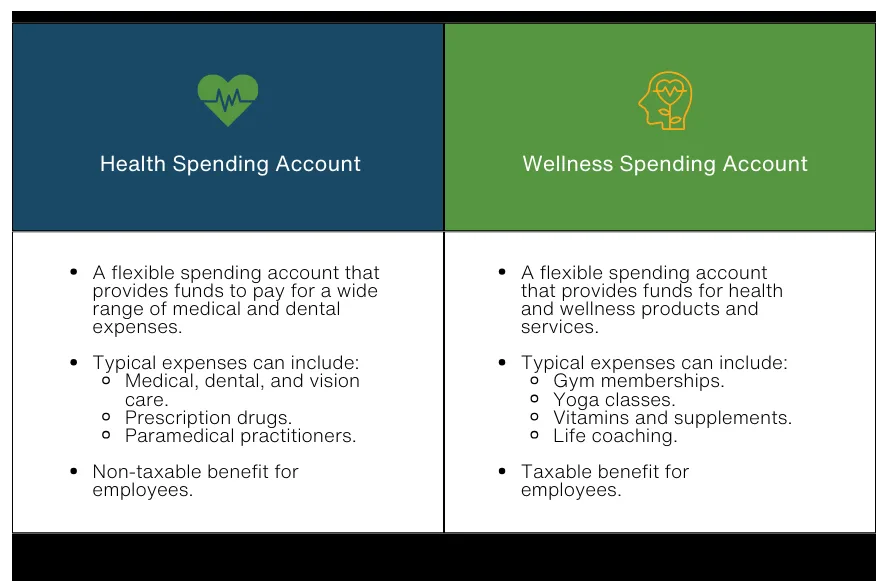

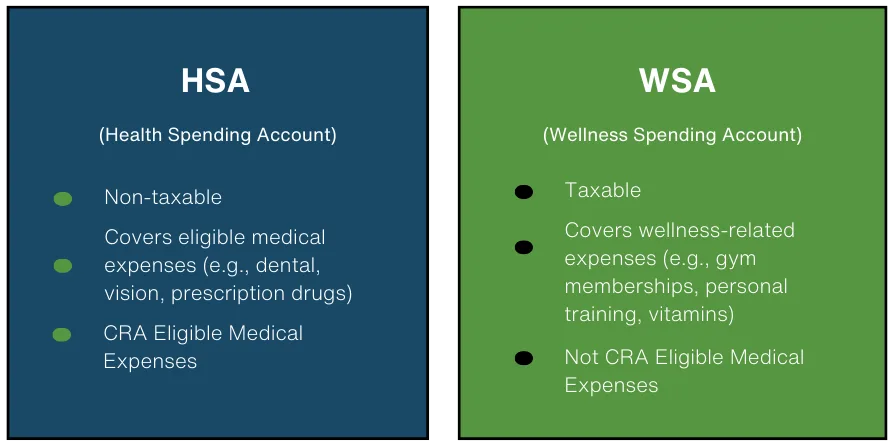

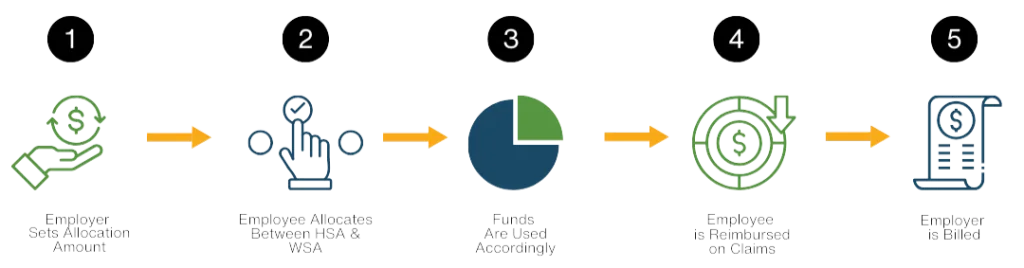

- Your Benefits, Your Way: The “101” on Health and Wellness Spending Accounts

- Three Reasons to Implement a Group Savings Plan - Latest News from Immix Group

- Add to your Recruitment and Retention Toolkit with a Group Savings Plan - Latest News from Immix Group

- 3 Action Steps Employers Can Take to Reduce Employee Financial Stress and Increase Financial Literacy - Latest News from Immix Group

- Employers' Guide – Taxable Benefits and Allowances - Canada.ca

- Contributions to savings and pension plans - Canada.ca

Lindsay Byrka, CFP® BA, BEd

Vice President, Immix Group: An Employee Benefits Company

A Suite 450 – 888 Dunsmuir St. Vancouver V6C 3K4

O 604-688-5262

Latest Insights

Your One-Stop Guide: Exploring Key Themes in Employee Benefits

A Guide to Immix Insights Articles Are you wondering what we’ve been writing about? Perhaps you haven’t had time to read the articles, but you’re hoping to gain some information