Employee Benefits Fraud in Canada: Awareness, Impact & Prevention

Lindsay Byrka, CFP® is Vice President at the Immix Group. She partners with employers to source and manage group life and health plans, and group savings and retirement plans, working with Canada’s leading insurers to support transparent pricing and flexible plan design. LinkedIn.

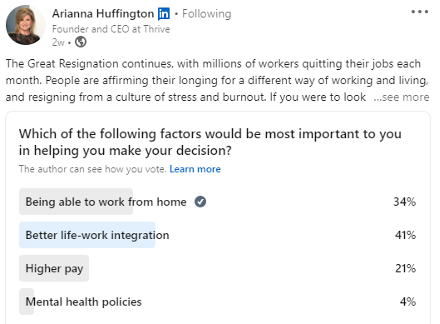

March is Fraud Prevention Month in Canada. Did you know that insurance fraud in Canada is estimated in the billions annually? A portion of that occurs within employer-sponsored group benefits. Industry sources have long suggested that benefits fraud may represent anywhere from 2–10% of total claims (estimates vary and are difficult to measure precisely).

The financial impact is direct. For most benefit plans, premiums are driven directly by claims experience. Every dollar paid out for an invalid claim, is a dollar that ultimately flows back into renewal calculations.

Who is committing benefits fraud?

More frequently than you might believe, we receive one of the dreaded notices: “We’re sorry to inform you that our auditors have discovered fraudulent claiming activities by a plan member.”

Despite how often we learn of fraud, we are always somewhat dumbfounded. It is often who you least expect (i.e. high-income professionals). Usually the amounts are small — $100 here, $150 there — but the behaviour is deliberate and surprisingly casual.

People speak openly about vendors who will “create a receipt.” One classic example? Receiving designer sunglasses (not prescription!) with an eyeglass receipt. Most individuals would never fabricate a receipt themselves — yet they barely blink at accepting what is, in effect, a falsified one. We often learn of this here in Vancouver, but also with clients across all provinces. It’s unfortunately common.

In one recent case in Ontario, a plan member submitted massage therapy claims for appointments that never occurred. The fraud was uncovered when analytics showed the same practitioner had already billed for treating a different patient — under a different employer’s plan — at the exact same time. It was quickly determined that one of the plan members was guilty of submitting false claims.

Why would plan members risk benefits fraud?

If someone believed there was very little chance of getting caught, would they submit a claim for $100 for a service they never received? For some, the answer is yes. Benefits fraud here in Canada is often rationalized as minor — more like speeding or jaywalking than theft. It can feel technical, harmless, even commonplace.

But benefit plan fraud is not minor. The well-known Toronto Transit Commission fraud case led to more than 200 employee dismissals and multiple criminal convictions including jail time.

In this case, an orthotics provider issued receipts to TTC employees for either inflated amounts or without delivering a product or service. The orthotics store then split the insurance payments with the plan member. It was only discovered through a tip to the TTC. The TTC even sued the insurance provider, blaming them for not discovering the fraud. The consequences can be serious and career-altering. So why do people do it?

Common reasons people commit benefits fraud include:

- They believe they won’t get caught. The amounts seem small and low-risk.

- They view it as minor, “not a big deal.” It doesn’t feel like real fraud.

- Others are doing it, and it seems commonplace.

- They feel entitled. A belief that they are “owed” something from the plan.

- They misunderstand who pays. Many don’t realize it’s ultimately their employer — not just an insurer — absorbing the cost.

- Ease of submission. Digital claims processes and providers that don’t require receipts can create a false sense of security and anonymity.

In reality, fraud detection systems are sophisticated, and any claim can trigger an investigation.

Who commits benefits fraud and what does this look like?

Fraud can be committed by plan members, by providers, through collusion between providers and claimants, or by third party bad actors.

Examples of Health, Dental and Disability Fraud

- Billing for services not rendered- the plan member never received the services, yet they submit a claim using a real practitioner’s details, in order to receive back funds

- Claims submitted under a licensed provider’s name when services were delivered by someone else (i.e. an unlicensed practitioner).

- Inflated procedure codes- the dental office bills the insurer for more time than they actually took, or more expensive procedure codes than the actual services.

- Coverage ‘stacking’- one member of a family has maxed out their annual limit, so the provider now submits the claim under a dependent’s name instead.

- Dual coverage abuse- submitting the same claim to multiple plans, without acknowledging payment from the other plan (i.e. being reimbursed twice for the same service). Not following COB rules.

- Ineligible dependents posing as eligible dependents (i.e. listing a niece, nephew as dependent child).

- Organized provider fraud rings- accessing benefits programs via employees at provider offices (i.e. the TTC incident)

- For disability claims, misrepresenting your ability to work, the extent of your injuries, or undisclosed employment while receiving disability benefits are all examples of benefits fraud.

How does benefits fraud negatively impact employee benefit program costs?

At the Immix Group, we spend a lot of time explaining pricing to employers in our Client Community, and coming up with strategies to provide comprehensive benefits, but with sustainable pricing. Our clients understand that claims (relative to premiums paid) are an important factor in pricing for most traditional SMB benefit plans.

In short, when money is paid out to people and practitioners for services and supplies that were not rendered or under other invalid circumstances, it drives program costs.

- Fraud increases claims costs, which drives the incurred loss ratios on the plan (ratio of the claims paid out, to the premiums collected)

- Higher incurred loss ratios result in premiums increasing.

- Less money is available to pay for true expenses. Employers must absorb increases or make plan design changes to reduce costs.

- The added cost of needing to audit, track, police, invest in technology etc. just to prevent and identify fraud additionally drives administrative costs industry-wide.

Ultimately, employers absorb much of the impact, as they are primary funders of benefit programs. Employees are also impacted if there is cost-sharing for the benefits premiums. Fortunately, the insurance industry has significantly strengthened its detection capabilities.

What are benefits insurance providers doing to prevent and detect fraud?

The good news is that benefits insurers are taking action. Fraud prevention technology has advanced significantly in recent years, with heavy investment in data analytics, artificial intelligence (AI), and collaborative industry initiatives to detect suspicious activity earlier and more accurately.

While digital claims submission may seem like it would make fraud easier, it actually strengthens detection efforts. Electronic claims create centralized, structured data that can be analyzed in real time. This allows insurers to identify unusual patterns, compare activity across providers, and flag concerns much faster than in paper-based systems.

Today’s fraud prevention efforts include:

- Advanced analytics and predictive modeling to detect unusual claiming patterns

- AI-based anomaly detection to flag claims that don’t align with typical behaviour

- Cross-provider and cross-carrier data comparisons to uncover duplication or coordinated activity

- Provider audits and verification processes to confirm services were actually delivered

- Collaboration across the industry, including initiatives led by organizations like the CLHIA to pool data and strengthen fraud detection

- Partnerships with law enforcement when criminal activity is identified

Insurers also monitor for practical warning signs such as:

- Unusual spikes in claims from a single provider or clinic location

- High-cost claims clustered in one geographic location

- Repeated maximum claims submitted early in the benefit year

- Consistent paramedical claims hitting annual limits

- Multiple employees at one organization using the same provider

At the same time, insurers recognize that fraudsters are becoming more sophisticated — using digital tools to fabricate receipts or manipulate systems. This is why fraud prevention is an ongoing investment. Overall, the industry’s approach is proactive, collaborative, and increasingly technology-driven — helping protect the long-term sustainability of employee benefit plans while ensuring legitimate claims are paid quickly and efficiently.

What can employers do to prevent benefits fraud?

The good news is employers do not need to initiate their own audits. Insurers are already monitoring plans at multiple levels. The most effective role employers can play is fostering a culture of honesty, awareness, and accountability. Employers can:

- Clearly communicate that benefits fraud is not victimless. It impacts plan sustainability and future costs

- Reinforce that fraud is a serious offence that can lead to termination and legal consequences

- Maintain a written policy outlining expectations and repercussions

- Educate employees on how benefits work and who ultimately funds the plan

- Encourage ethical decision-making and speak openly about integrity

- Ensure employees know how to report suspected fraud

Fraud often begins with the mindset that “everyone does it” or “it’s not a lot of money.” Leadership tone matters. When organizations consistently promote transparency and accountability, it strengthens the long-term health of the benefit plan for everyone.

Want to learn more about what you can do? CLHIA has excellent information, as do many insurance carriers including Pacific Blue Cross, Manulife Financial, SunLife Financial, and Canada Life.

At the Immix Group, we are happy to help employers craft communication pieces to distribute to staff, or to educate HR staff and employees on this topic. As always, please feel free to reach out.

FAQs

-

How common is benefits fraud in Canada?

It’s estimated in the billions annually, although it’s difficult to measure.

-

Who commits benefits fraud?

Plan members, providers, or both working together — and sometimes third parties.

-

What are common examples of fraud?

Claiming services not received, inflating charges, submitting duplicate claims, or misrepresenting eligibility.

-

How does fraud impact benefit plans?

It increases claims costs, which can lead to higher premiums (and subsequently, less funds available for legitimate claims).

-

What can employers do to help prevent fraud?

Promote a culture of honesty, clearly communicate that fraud has serious consequences, educate employees on how plans are funded, and encourage ethical decision-making.

Key Takeaways

- Benefits fraud is more common than many realize, can have a meaningful financial impact on employer-sponsored group benefit plans, and can be detected.

- Fraud is not “victimless.” Increased claims costs ultimately affect employers and employees through higher premiums.

- Detection systems are sophisticated and increasingly powered by data analytics and AI — suspicious activity is often identified quickly, with insurers and other organization coordinating prevention and detection efforts.

- Fraud can involve plan members, providers, or organized activity, and the consequences can be serious and career-altering.

- Employers play an important role by reinforcing clear expectations, promoting integrity, and building awareness around responsible use of benefit plans.

Read More

- March is Fraud Prevention Month - Latest News from Immix Group

- B.C. RMT suspended for submitting false insurance claims : A news story detailing disciplinary action against a registered massage therapist for billing insurers for services not provided.

- Aviva Canada: New data shows staggering rise in fraud across the country as Fraud Prevention Month kicks off : Aviva reports on rising fraud trends across Canada, highlighting new data and reinforcing the need for stronger prevention efforts.

- CLHIA - Life and health insurers to use advanced artificial intelligence to reduce benefits fraud : CLHIA outlines how insurers are using AI and advanced analytics to detect suspicious claims and reduce benefits fraud.

- TTC benefits fraud investigation update: 223 employees dismissed : An update on the TTC fraud case where over 200 employees were terminated following a large-scale benefits fraud investigation.

- CLHIA - How to report benefits fraud and abuse : A resource explaining how individuals can confidentially report suspected insurance fraud or abuse.

- Pacific Blue Cross Benefits Fraud : Pacific Blue Cross explains common types of benefits fraud, warning signs, and how they investigate and prevent fraudulent claims.

- Fraud prevention for plan members - Group plans | Manulife : Manulife provides guidance for plan members on recognizing fraud, protecting personal information, and using benefits responsibly.

- Fraud Risk Management | Workplace Benefits and Retirement Services : An overview of how Sun Life manages fraud risk through monitoring, analytics, audits, and prevention strategies.

- Protecting yourself online – Dos and don’ts in the fight against fraud : Practical tips to help individuals protect personal and financial information from online scams and digital fraud.

Lindsay Byrka, CFP® BA, BEd

Vice President, Immix Group: An Employee Benefits Company

A Suite 450 – 888 Dunsmuir St. Vancouver V6C 3K4

O 604-688-5262

Latest Insights

Your One-Stop Guide: Exploring Key Themes in Employee Benefits

A Guide to Immix Insights Articles Are you wondering what we’ve been writing about? Perhaps you haven’t had time to read the articles, but you’re hoping to gain some information